2.1 — Random Variables & Distributions

ECON 480 • Econometrics • Fall 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/metricsF21

metricsF21.classes.ryansafner.com

Random Variables

Experiments

- An experiment is any procedure that can (in principle) be repeated infinitely and has a well-defined set of outcomes

Example: flip a coin 10 times

Random Variables

A random variable (RV) takes on values that are unknown in advance, but determined by an experiment

A numerical summary of a random outcome

Example: the number of heads from 10 coin flips

Random Variables: Notation

Random variable X takes on individual values (xi) from a set of possible values

Often capital letters to denote RV's

- lowercase letters for individual values

Example: Let X be the number of Heads from 10 coin flips. xi∈{0,1,2,...,10}

Discrete Random Variables

Discrete Random Variables

- A discrete random variable: takes on a finite/countable set of possible values

Example: Let X be the number of times your computer crashes this semester1, xi∈{0,1,2,3,4}

1 Please, back up your files!

Discrete Random Variables: Probability Distribution

- Probability distribution of a R.V. fully lists all the possible values of X and their associated probabilities

Example:

| xi | P(X=xi) |

|---|---|

| 0 | 0.80 |

| 1 | 0.10 |

| 2 | 0.06 |

| 3 | 0.03 |

| 4 | 0.01 |

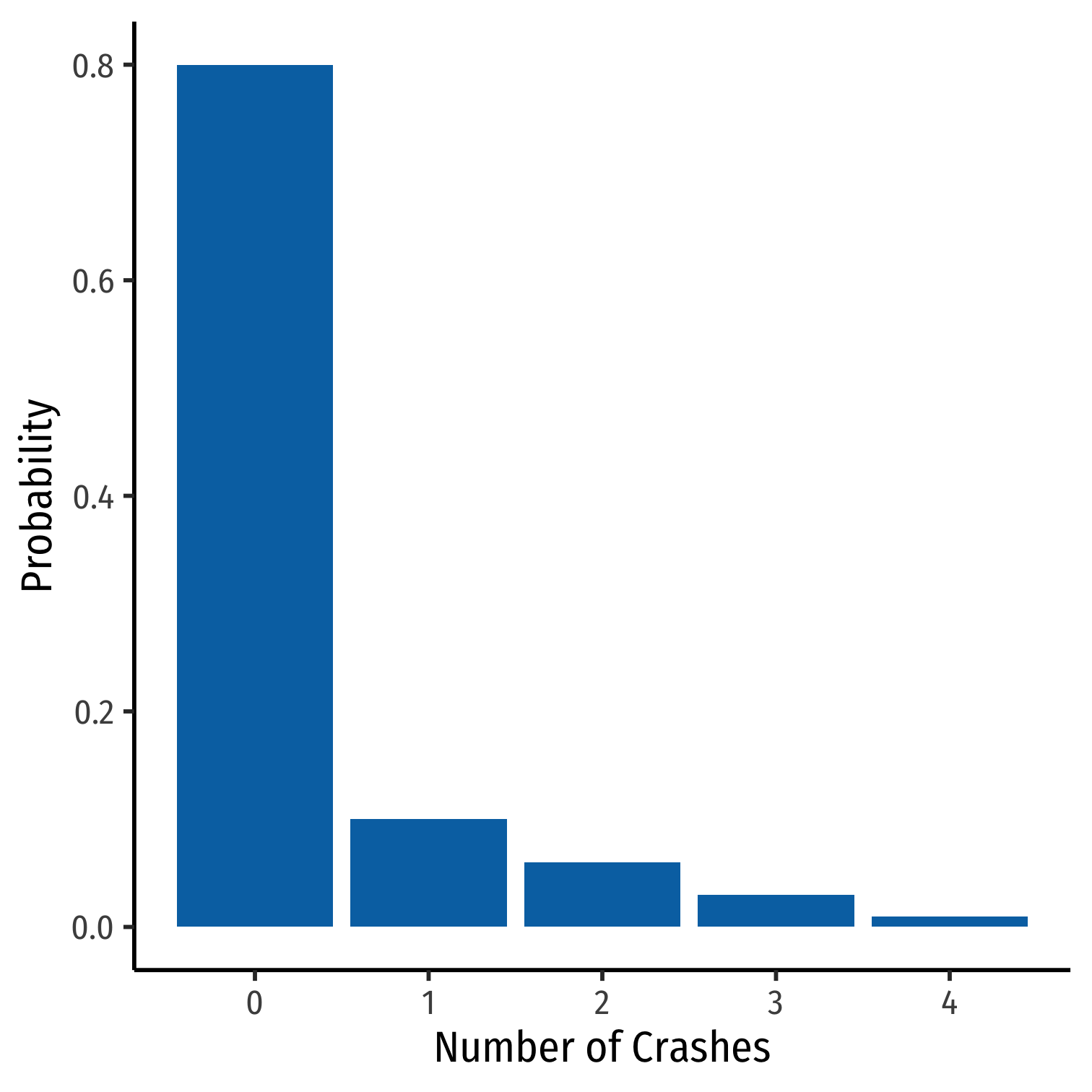

Discrete Random Variables: pdf

Probability distribution function (pdf) summarizes the possible outcomes of X and their probabilities

- Notation: fX is the pdf of X:

fX=pi,i=1,2,...,k

- For any real number xi, f(xi) is the probablity that X=xi

Example:

| xi | P(X=xi) |

|---|---|

| 0 | 0.80 |

| 1 | 0.10 |

| 2 | 0.06 |

| 3 | 0.03 |

| 4 | 0.01 |

Discrete Random Variables: pdf

Probability distribution function (pdf) summarizes the possible outcomes of X and their probabilities

- Notation: fX is the pdf of X:

fX=pi,i=1,2,...,k

- For any real number xi, f(xi) is the probablity that X=xi

Example:

| xi | P(X=xi) |

|---|---|

| 0 | 0.80 |

| 1 | 0.10 |

| 2 | 0.06 |

| 3 | 0.03 |

| 4 | 0.01 |

- What is f(0)?

Discrete Random Variables: pdf

Probability distribution function (pdf) summarizes the possible outcomes of X and their probabilities

- Notation: fX is the pdf of X:

fX=pi,i=1,2,...,k

- For any real number xi, f(xi) is the probablity that X=xi

Example:

| xi | P(X=xi) |

|---|---|

| 0 | 0.80 |

| 1 | 0.10 |

| 2 | 0.06 |

| 3 | 0.03 |

| 4 | 0.01 |

What is f(0)?

What is f(3)?

Discrete Random Variables: pdf Graph

crashes<-tibble(number = c(0,1,2,3,4), prob = c(0.80, 0.10, 0.06, 0.03, 0.01))ggplot(data = crashes)+ aes(x = number, y = prob)+ geom_col(fill="#0072B2")+ labs(x = "Number of Crashes", y = "Probability")+ theme_classic(base_family = "Fira Sans Condensed", base_size=20)

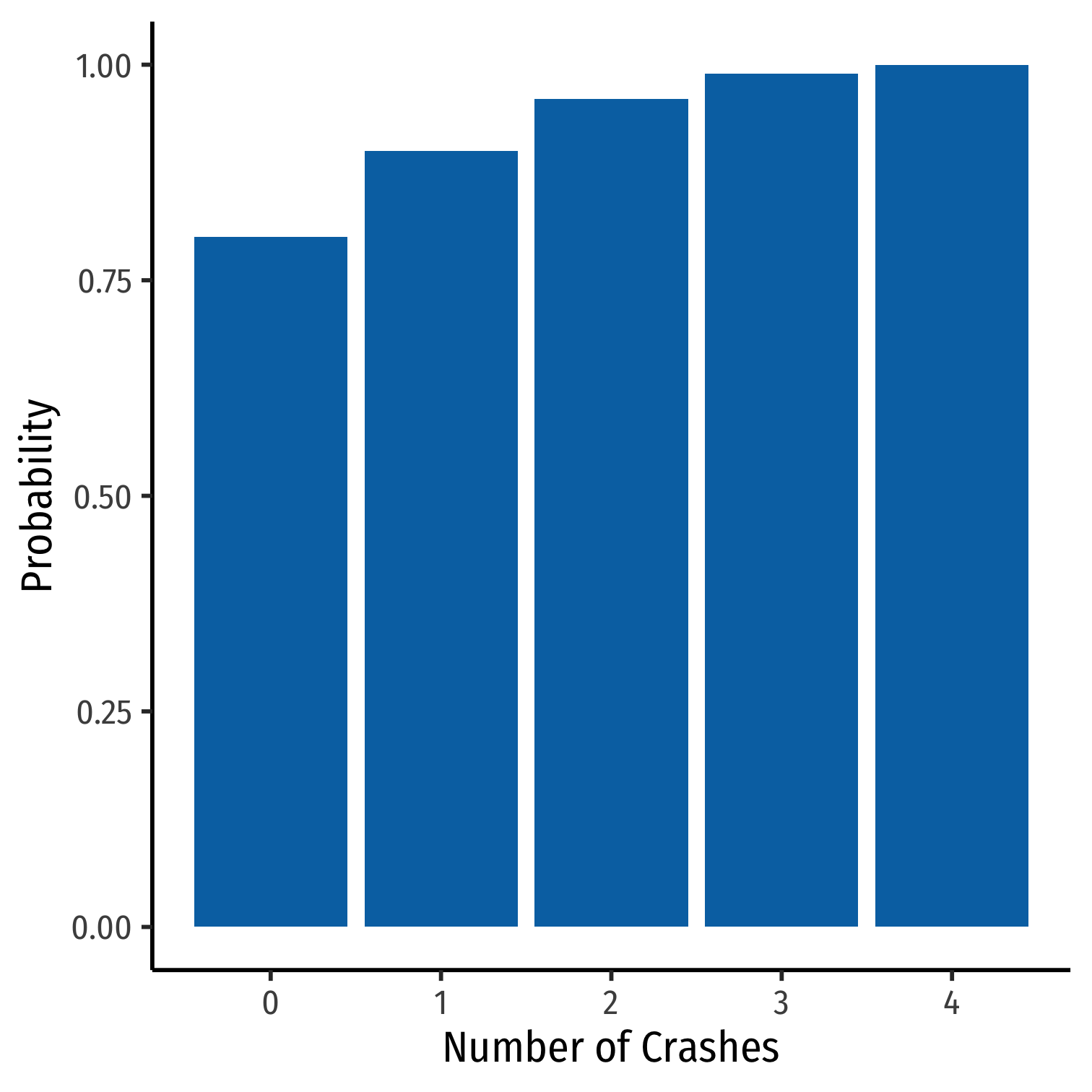

Discrete Random Variables: cdf

Cumulative distribution function (pdf) lists probability X will be at most (less than or equal to) a given value xi

- Notation: FX=P(X≤xi)

Example:

| xi | f(x) | F(x) |

|---|---|---|

| 0 | 0.80 | 0.80 |

| 1 | 0.10 | 0.90 |

| 2 | 0.06 | 0.96 |

| 3 | 0.03 | 0.99 |

| 4 | 0.01 | 1.00 |

Discrete Random Variables: cdf

Cumulative distribution function (pdf) lists probability X will be at most (less than or equal to) a given value xi

- Notation: FX=P(X≤xi)

Example:

| xi | f(x) | F(x) |

|---|---|---|

| 0 | 0.80 | 0.80 |

| 1 | 0.10 | 0.90 |

| 2 | 0.06 | 0.96 |

| 3 | 0.03 | 0.99 |

| 4 | 0.01 | 1.00 |

- What is the probability your computer will crash at most once, F(1)?

Discrete Random Variables: cdf

Cumulative distribution function (pdf) lists probability X will be at most (less than or equal to) a given value xi

- Notation: FX=P(X≤xi)

Example:

| xi | f(x) | F(x) |

|---|---|---|

| 0 | 0.80 | 0.80 |

| 1 | 0.10 | 0.90 |

| 2 | 0.06 | 0.96 |

| 3 | 0.03 | 0.99 |

| 4 | 0.01 | 1.00 |

What is the probability your computer will crash at most once, F(1)?

What about three times, F(3)?

Discrete Random Variables: cdf Graph

crashes<-crashes %>% mutate(cum_prob = cumsum(prob))crashes## # A tibble: 5 × 3## number prob cum_prob## <dbl> <dbl> <dbl>## 1 0 0.8 0.8 ## 2 1 0.1 0.9 ## 3 2 0.06 0.96## 4 3 0.03 0.99## 5 4 0.01 1ggplot(data = crashes)+ aes(x = number, y = cum_prob)+ geom_col(fill="#0072B2")+ labs(x = "Number of Crashes", y = "Probability")+ theme_classic(base_family = "Fira Sans Condensed", base_size=20)

Expected Value and Variance

Expected Value of a Random Variable

- Expected value of a random variable X, written E(X) (and sometimes μ), is the long-run average value of X "expected" after many repetitions

E(X)=k∑i=1pixi

Expected Value of a Random Variable

- Expected value of a random variable X, written E(X) (and sometimes μ), is the long-run average value of X "expected" after many repetitions

E(X)=k∑i=1pixi

E(X)=p1x1+p2x2+⋯+pkxk

A probability-weighted average of X, with each xi weighted by its associated probability pi

Also called the "mean" or "expectation" of X, always denoted either E(X) or μX

Expected Value: Example I

Example: Suppose you lend your friend $100 at 10% interest. If the loan is repaid, you receive $110. You estimate that your friend is 99% likely to repay, but there is a default risk of 1% where you get nothing. What is the expected value of repayment?

Expected Value: Example II

Example:

Let X be a random variable that is described by the following pdf:

| xi | P(X=xi) |

|---|---|

| 1 | 0.50 |

| 2 | 0.25 |

| 3 | 0.15 |

| 4 | 0.10 |

Calculate E(X).

The Steps to Calculate E(X), Coded

# Make a Random Variable called XX<-tibble(x_i=c(1,2,3,4), # values of X p_i=c(0.50,0.25,0.15,0.10)) # probabilitiesX %>% summarize(expected_value = sum(x_i*p_i))## # A tibble: 1 × 1## expected_value## <dbl>## 1 1.85Variance of a Random Variable

- The variance of a random variable X, denoted var(X) or σ2X is:

σ2X=E[(xi−μX)2]=n∑i=1(xi−μX)2pi

- This is the expected value of the squared deviations from the mean

- i.e. the probability-weighted average of the squared deviations

Standard Deviation of a Random Variable

- The standard deviation of a random variable X, denoted sd(X) or σX is:

σX=√σ2X

Standard Deviation: Example I

Example: What is the standard deviation of computer crashes?

| xi | P(X=xi) |

|---|---|

| 0 | 0.80 |

| 1 | 0.10 |

| 2 | 0.06 |

| 3 | 0.03 |

| 4 | 0.01 |

The Steps to Calculate sd(X), Coded I

# get the expected value crashes %>% summarize(expected_value = sum(number*prob))## # A tibble: 1 × 1## expected_value## <dbl>## 1 0.35# save this for quick useexp_value<-0.35crashes_2 <- crashes %>% select(-cum_prob) %>% # we don't need the cdf # create new columns mutate(deviations = number - exp_value, # deviations from exp_value deviations_sq = deviations^2, weighted_devs_sq = prob * deviations^2) # square deviationsThe Steps to Calculate sd(X), Coded II

# look at what we madecrashes_2## # A tibble: 5 × 5## number prob deviations deviations_sq weighted_devs_sq## <dbl> <dbl> <dbl> <dbl> <dbl>## 1 0 0.8 -0.35 0.122 0.098 ## 2 1 0.1 0.65 0.423 0.0423## 3 2 0.06 1.65 2.72 0.163 ## 4 3 0.03 2.65 7.02 0.211 ## 5 4 0.01 3.65 13.3 0.133The Steps to Calculate sd(X), Coded III

# now we want to take the expected value of the squared deviations to get variancecrashes_2 %>% summarize(variance = sum(weighted_devs_sq), # variance sd = sqrt(variance)) # sd is square root## # A tibble: 1 × 2## variance sd## <dbl> <dbl>## 1 0.648 0.805Standard Deviation: Example II

Example: What is the standard deviation of the random variable we saw before?

| xi | P(X=xi) |

|---|---|

| 1 | 0.50 |

| 2 | 0.25 |

| 3 | 0.15 |

| 4 | 0.10 |

Hint: you already found it's expected value.

Continuous Random Variables

Continuous Random Variables

Continuous random variables can take on an uncountable (infinite) number of values

So many values that the probability of any specific value is infinitely small: P(X=xi)→0

Instead, we focus on a range of values it might take on

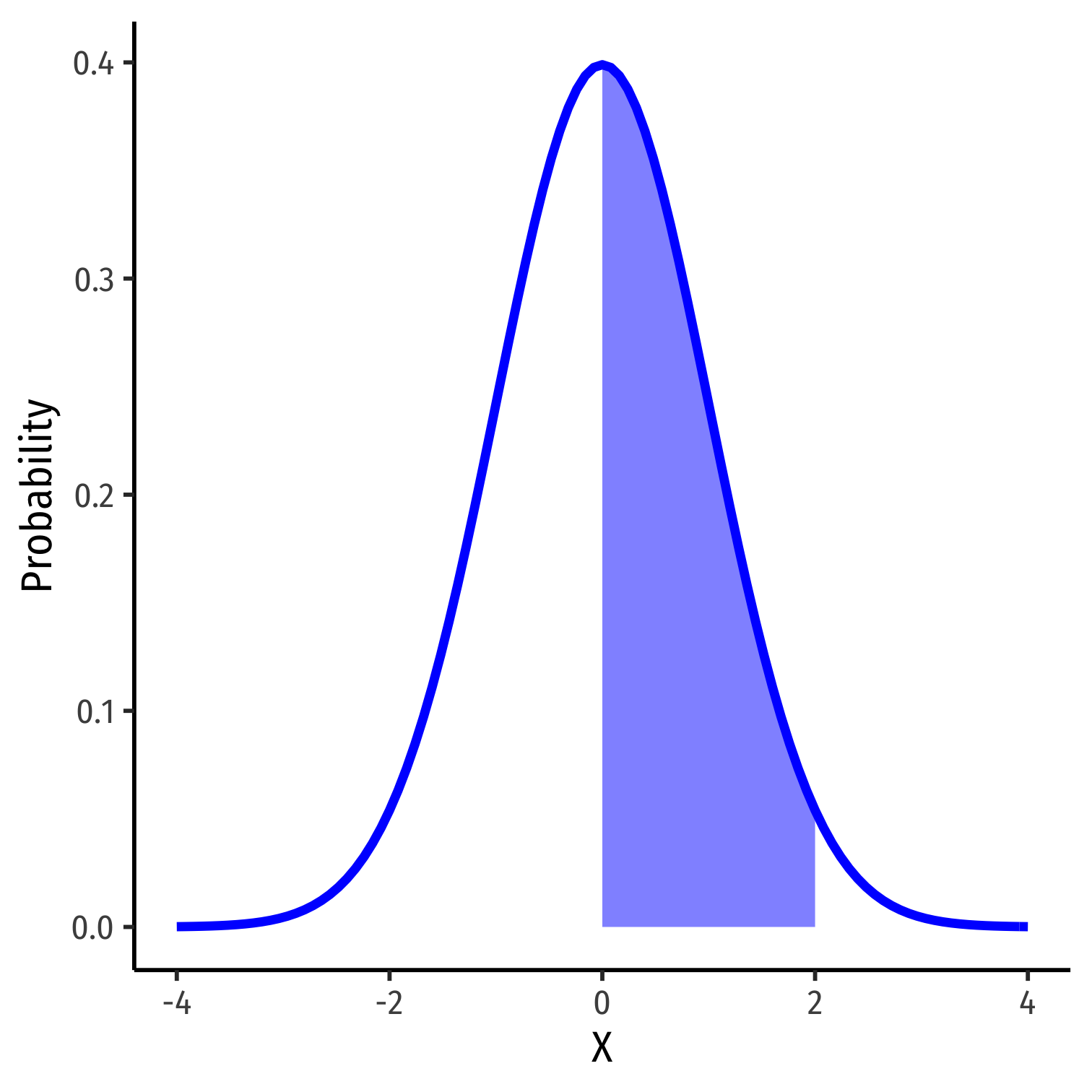

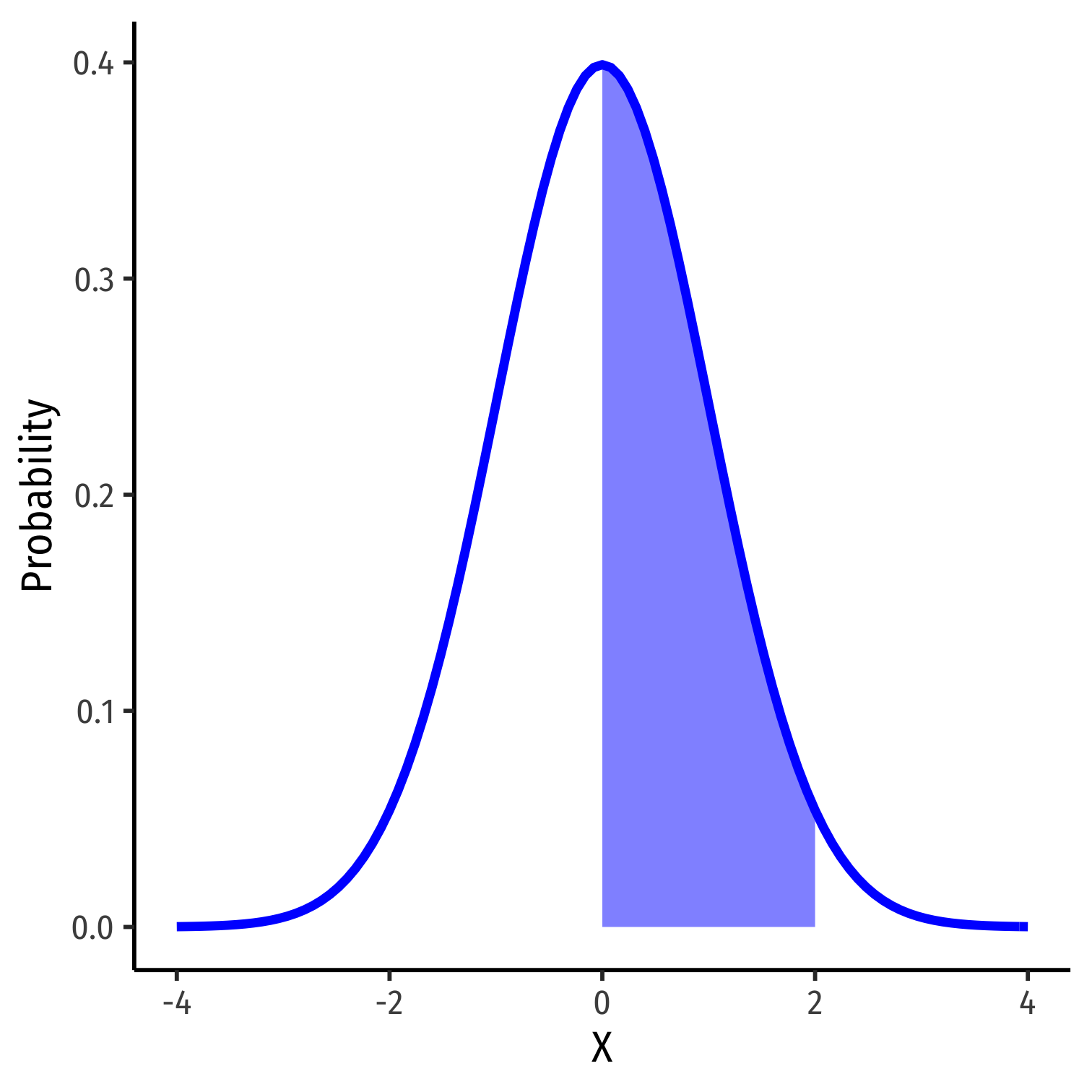

Continuous Random Variables: pdf I

Probability density function (pdf) of a continuous variable represents the probability between two values as the area under a curve

The total area under the curve is 1

Since P(a)=0 and P(b)=0, P(a<X<b)=P(a≤X≤b)

Example: P(0≤X≤2)

- See today's class notes for how to graph math/stats functions in

ggplot!

Continuous Random Variables: pdf II

- FYI using calculus:

P(a≤X≤b)=∫baf(x)dx

- Complicated: software or (old fashioned!) probability tables to calculate

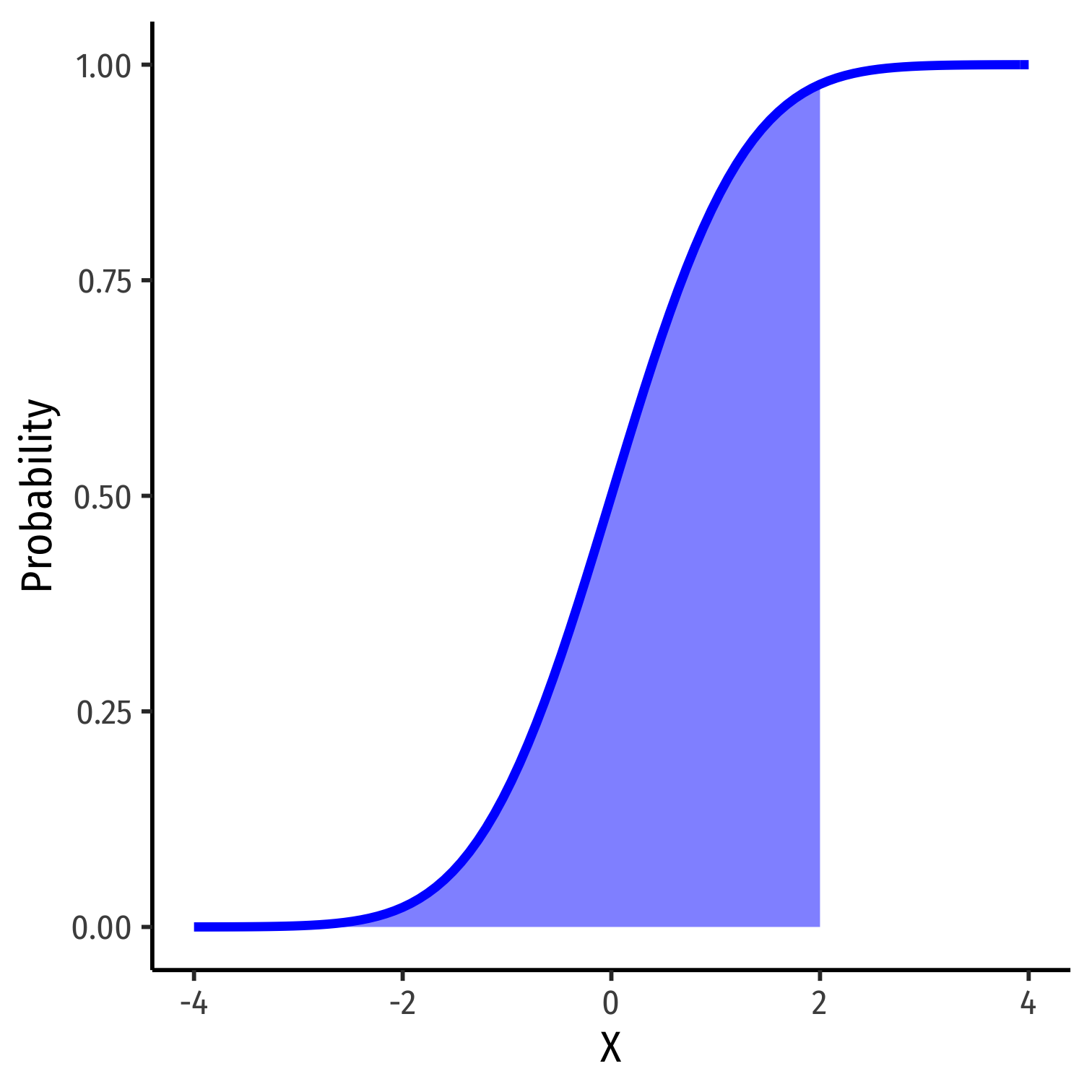

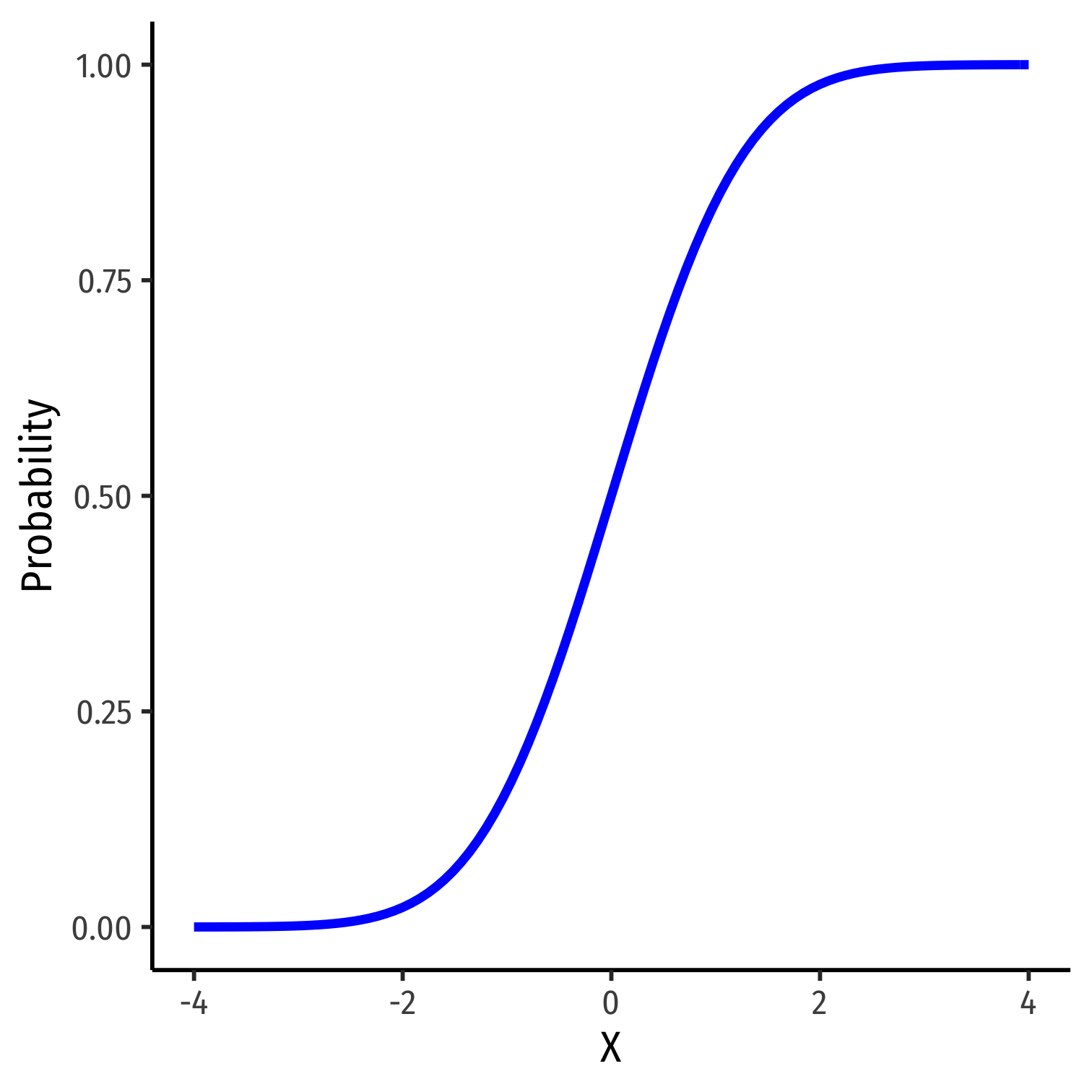

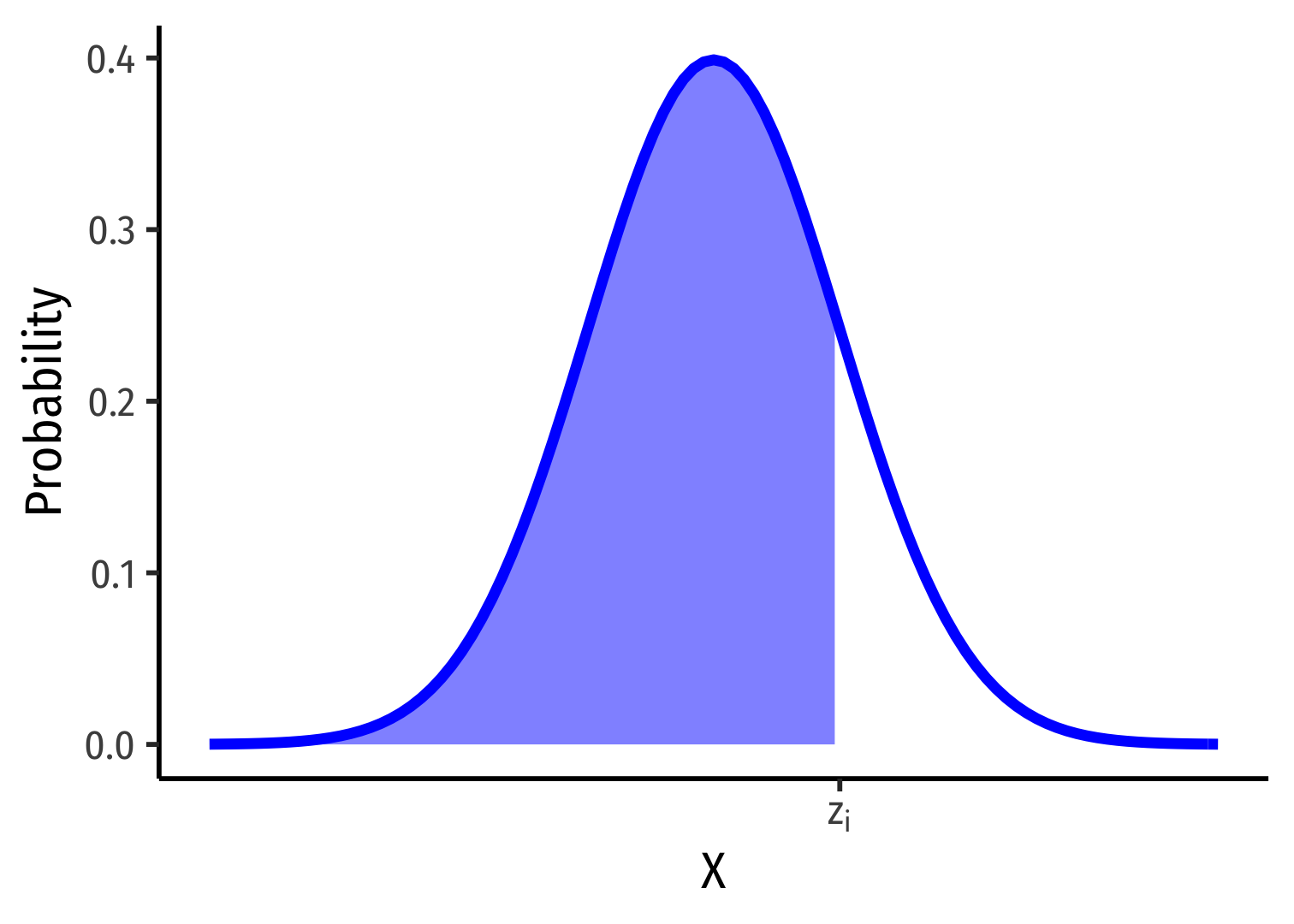

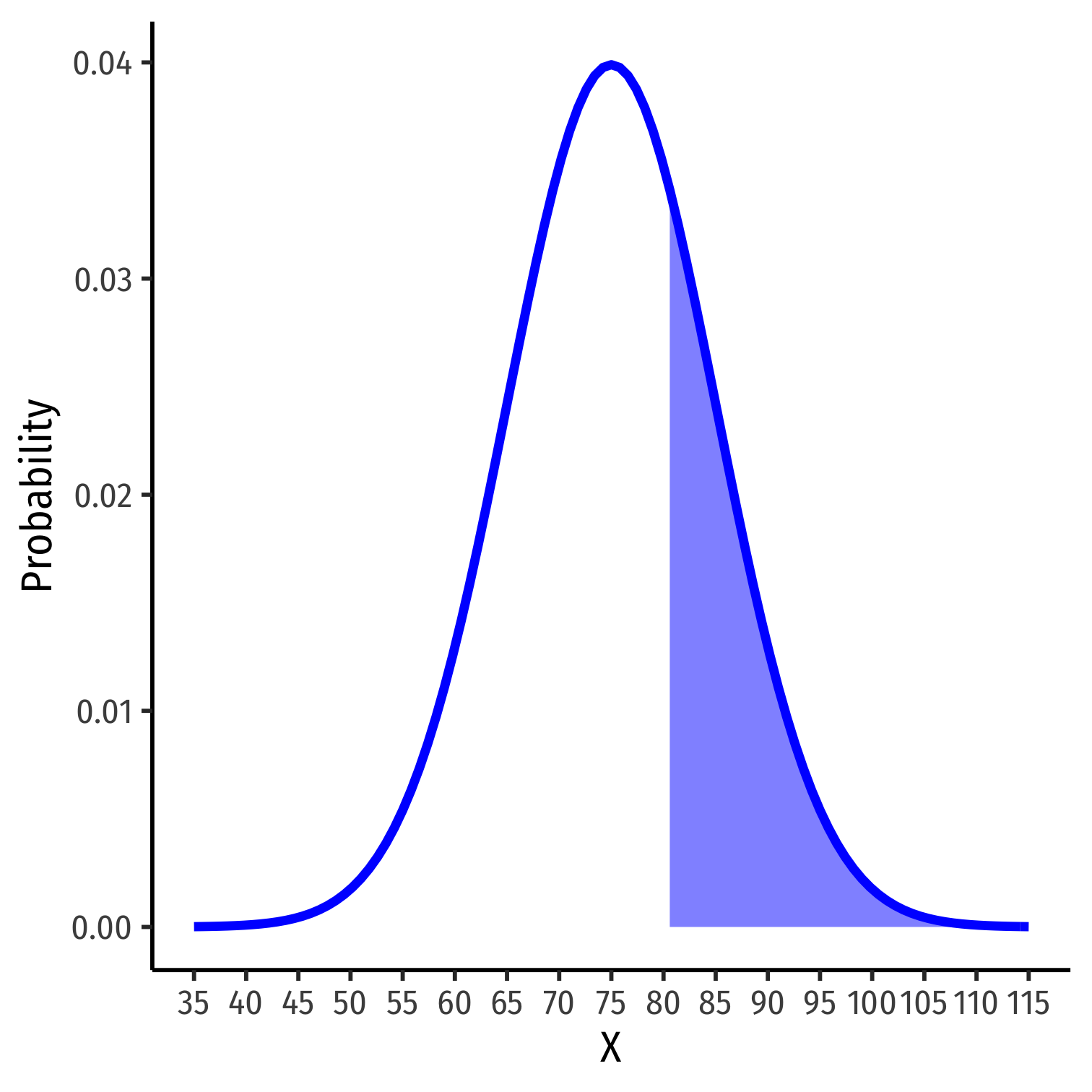

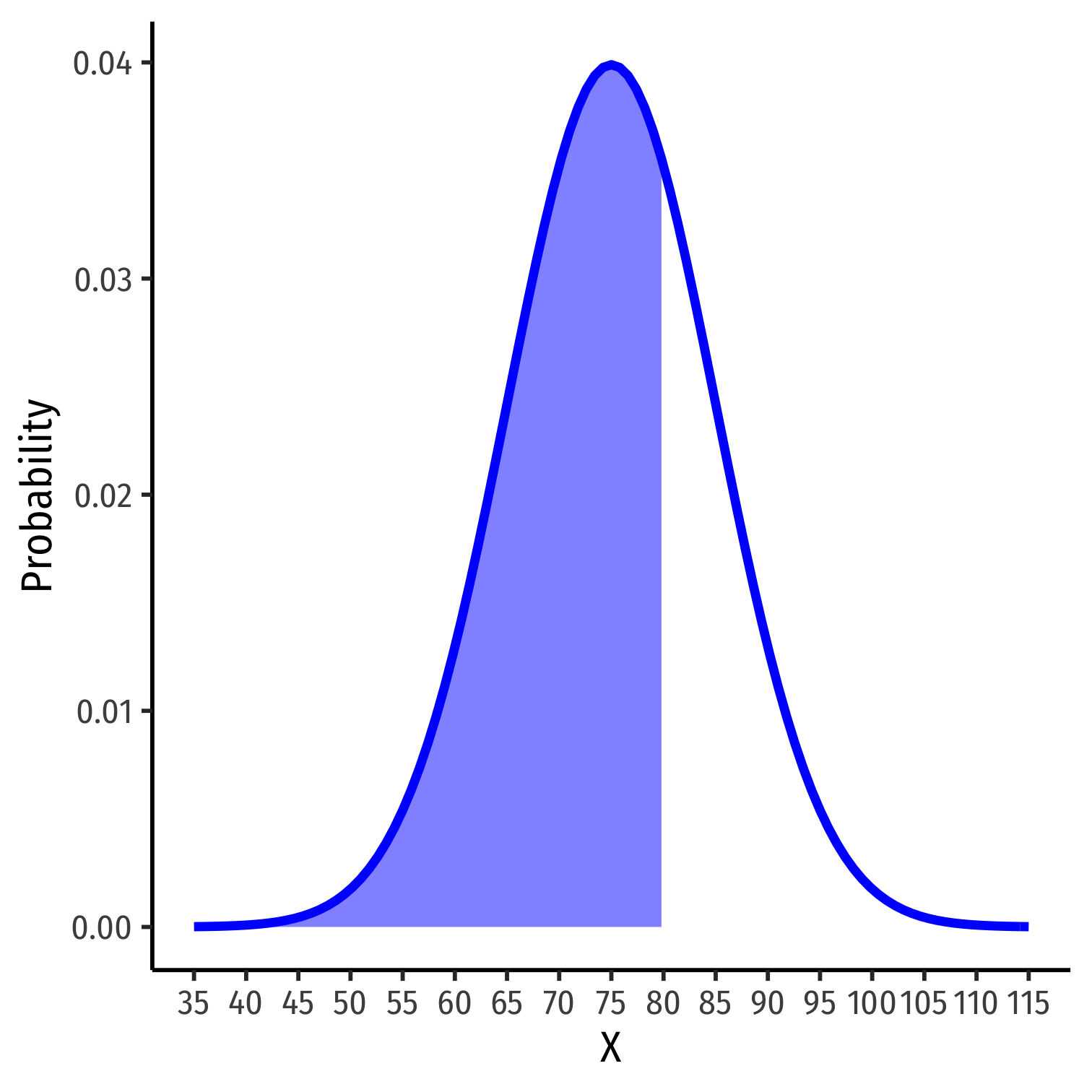

Continuous Random Variables: cdf I

- The cumulative density function (cdf) describes the area under the pdf for all values less than or equal to (i.e. to the left of) a given value, k

P(X≤k)

Example: P(X≤2)

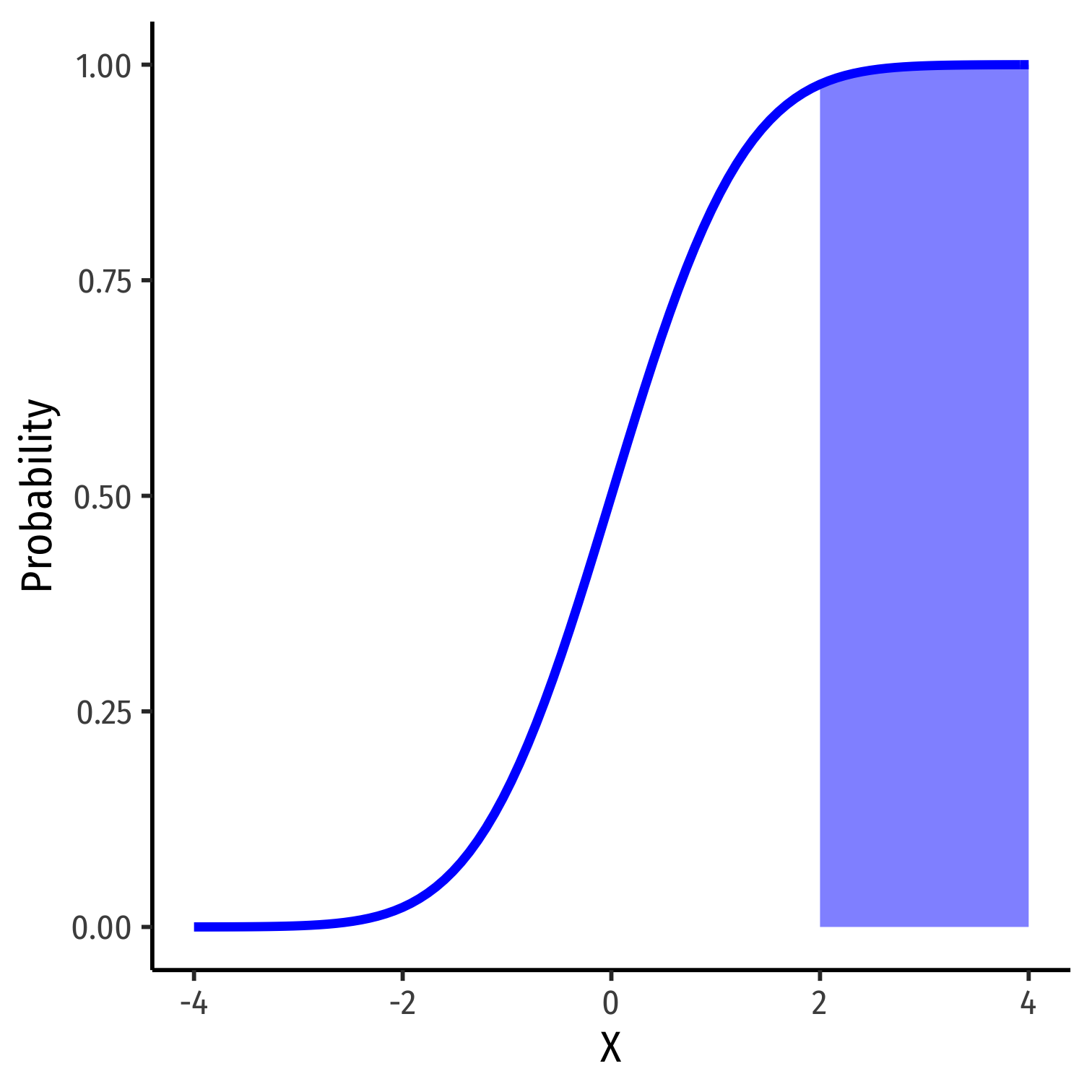

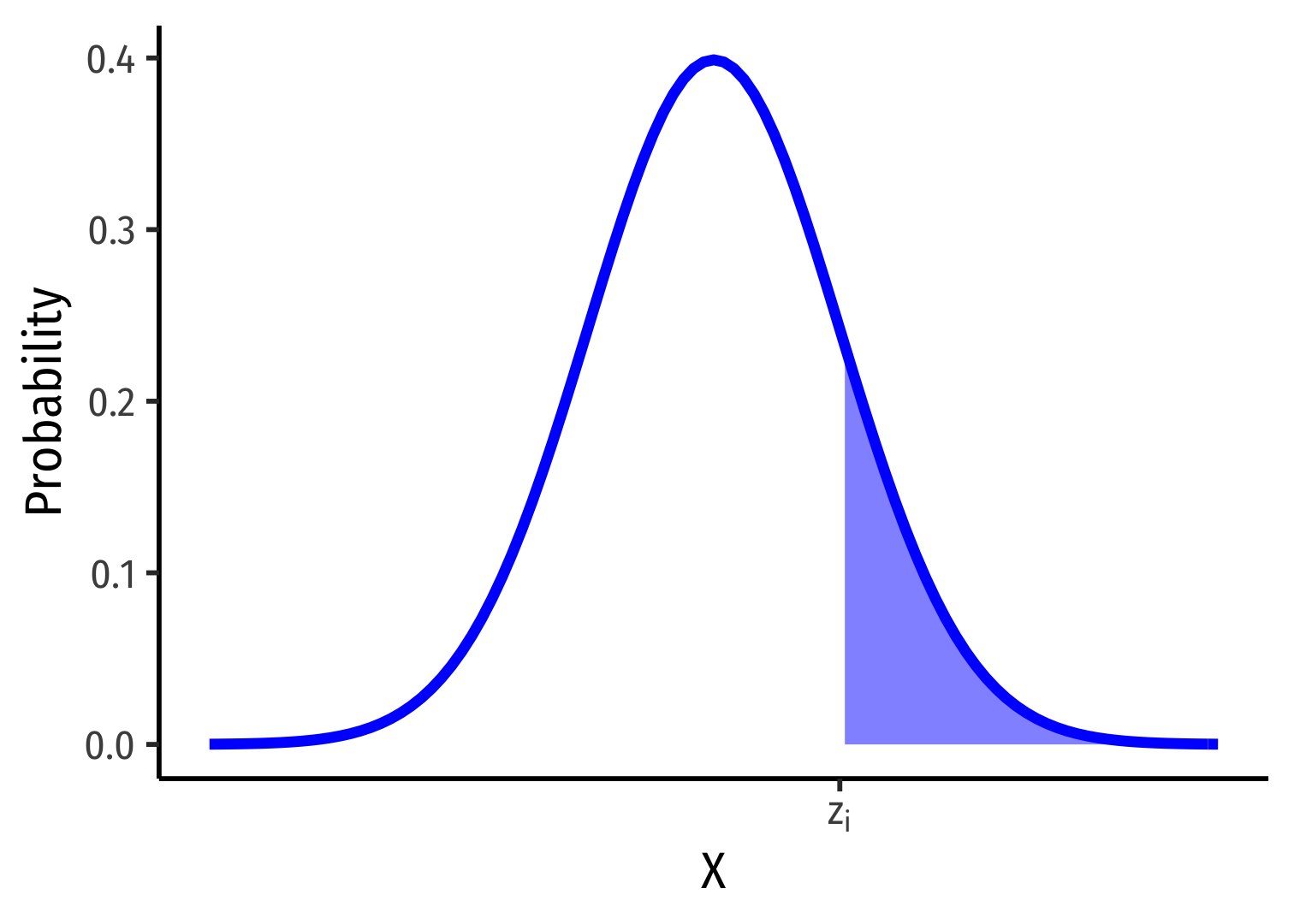

Continuous Random Variables: cdf II

- Note: to find the probability of values greater than or equal to (to the right of) a given value k:

P(X≥k)=1−P(X≤k)

Example: P(X≥2)=1−P(X≤2)

P(X≥2)= area under the curve to the right of 2

The Normal Distribution

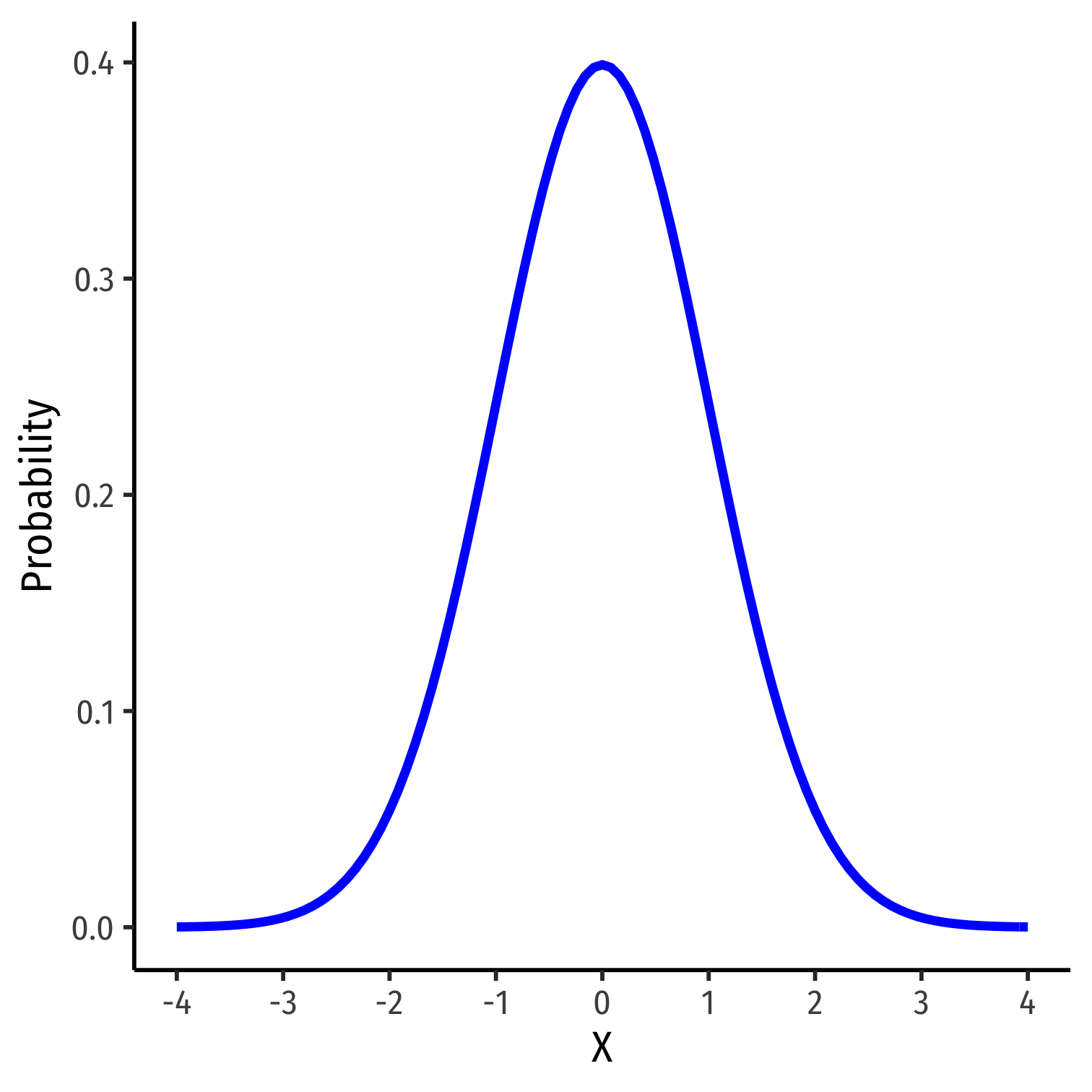

The Normal Distribution I

- The Gaussian or normal distribution is the most useful type of probability distribution

X∼N(μ,σ)

- Continuous, symmetric, unimodal, with mean μ and standard deviation σ

The Normal Distribution II

FYI: The pdf of X∼N(μ,σ) is P(X=k)=1√2πσ2e−12((k−μ)σ)2

Do not try and learn this, we have software and (previously tables) to calculate pdfs and cdfs

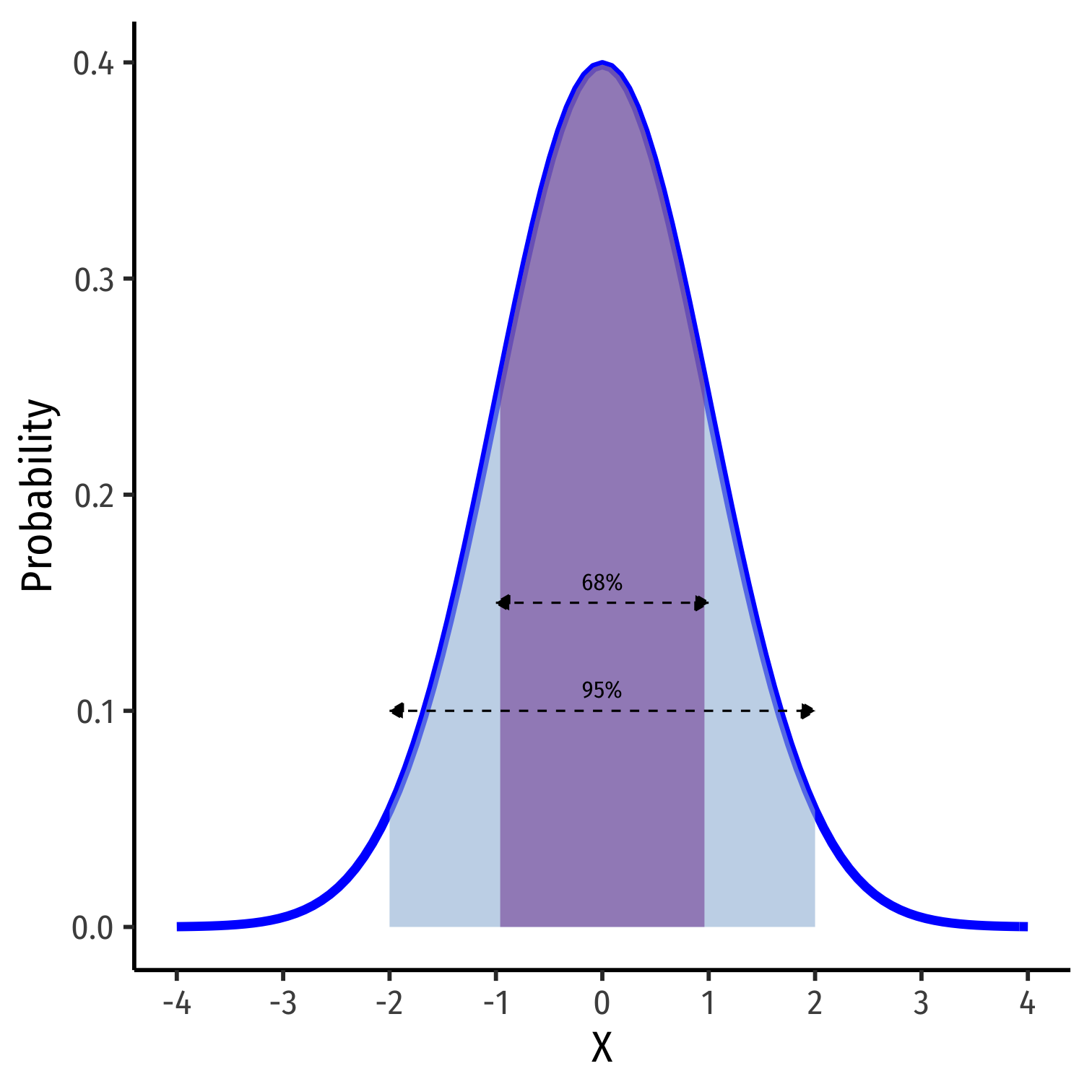

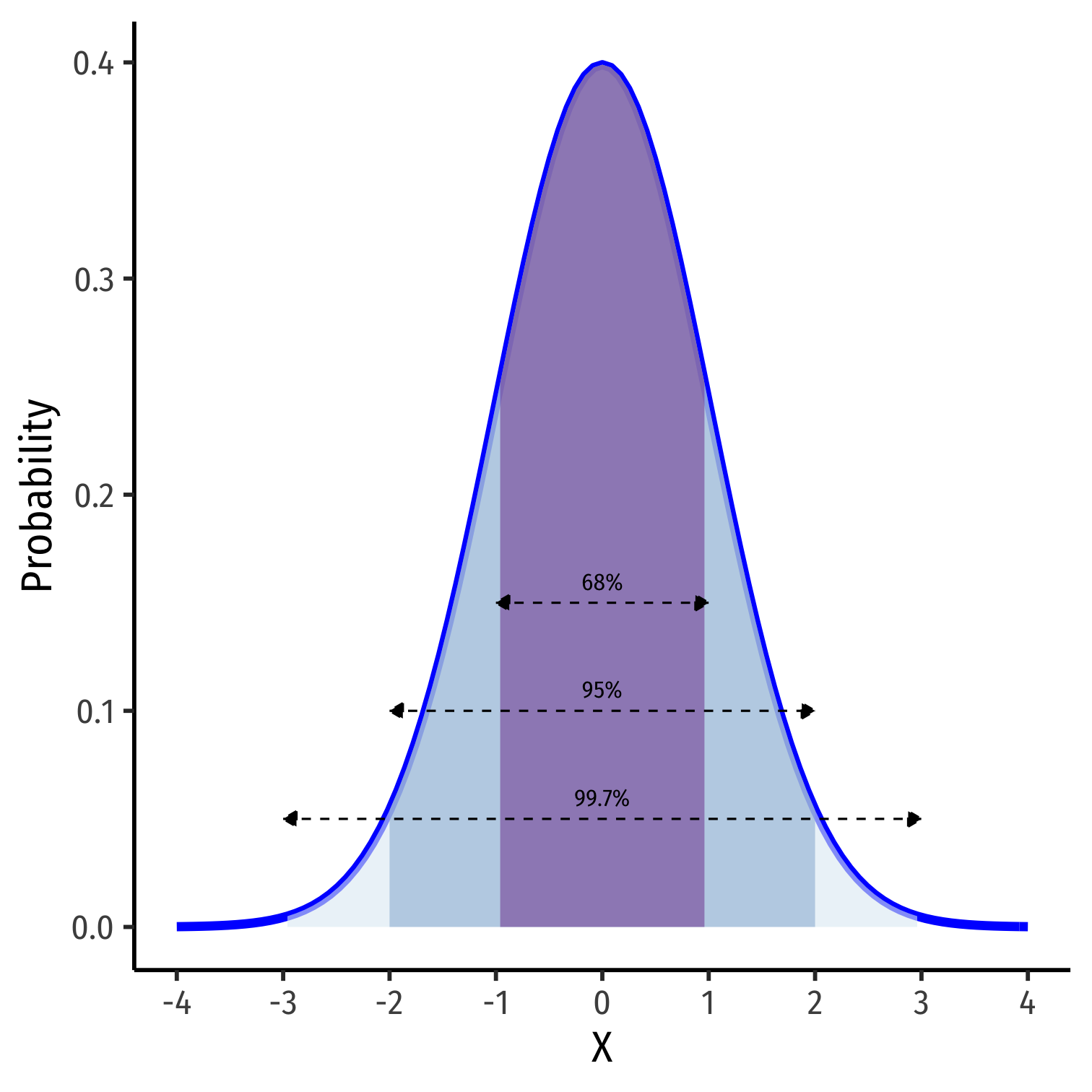

The 68-95-99.7 Rule

- 68-95-99.7% empirical rule: for a normal distribution:

The 68-95-99.7 Rule

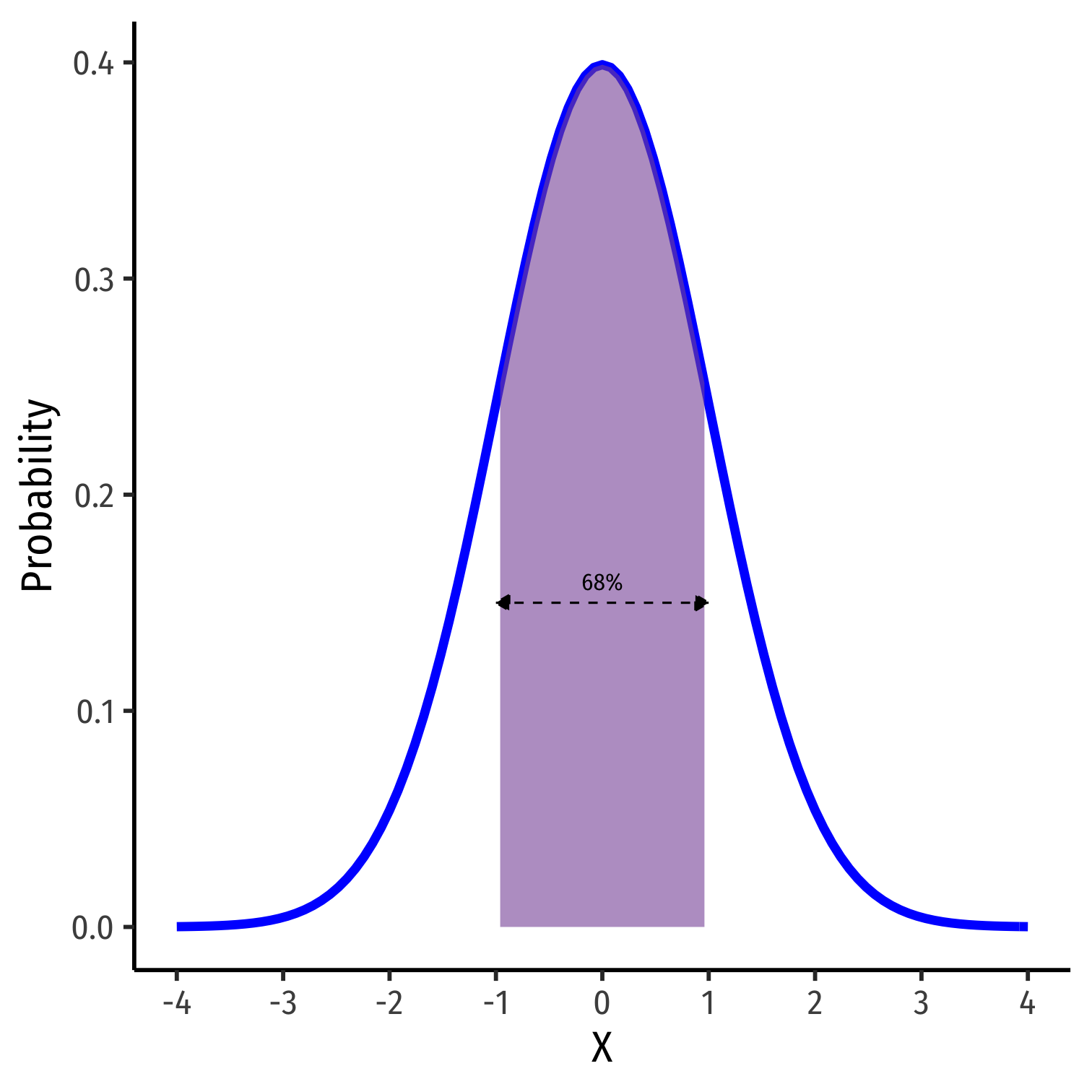

68-95-99.7% empirical rule: for a normal distribution:

P(μ−1σ≤X≤μ+1σ)≈ 68%

The 68-95-99.7 Rule

68-95-99.7% empirical rule: for a normal distribution:

P(μ−1σ≤X≤μ+1σ)≈ 68%

P(μ−2σ≤X≤μ+2σ)≈ 95%

The 68-95-99.7 Rule

68-95-99.7% empirical rule: for a normal distribution:

P(μ−1σ≤X≤μ+1σ)≈ 68%

P(μ−2σ≤X≤μ+2σ)≈ 95%

P(μ−3σ≤X≤μ+3σ)≈ 99.7%

68/95/99.7% of observations fall within 1/2/3 standard deviations of the mean

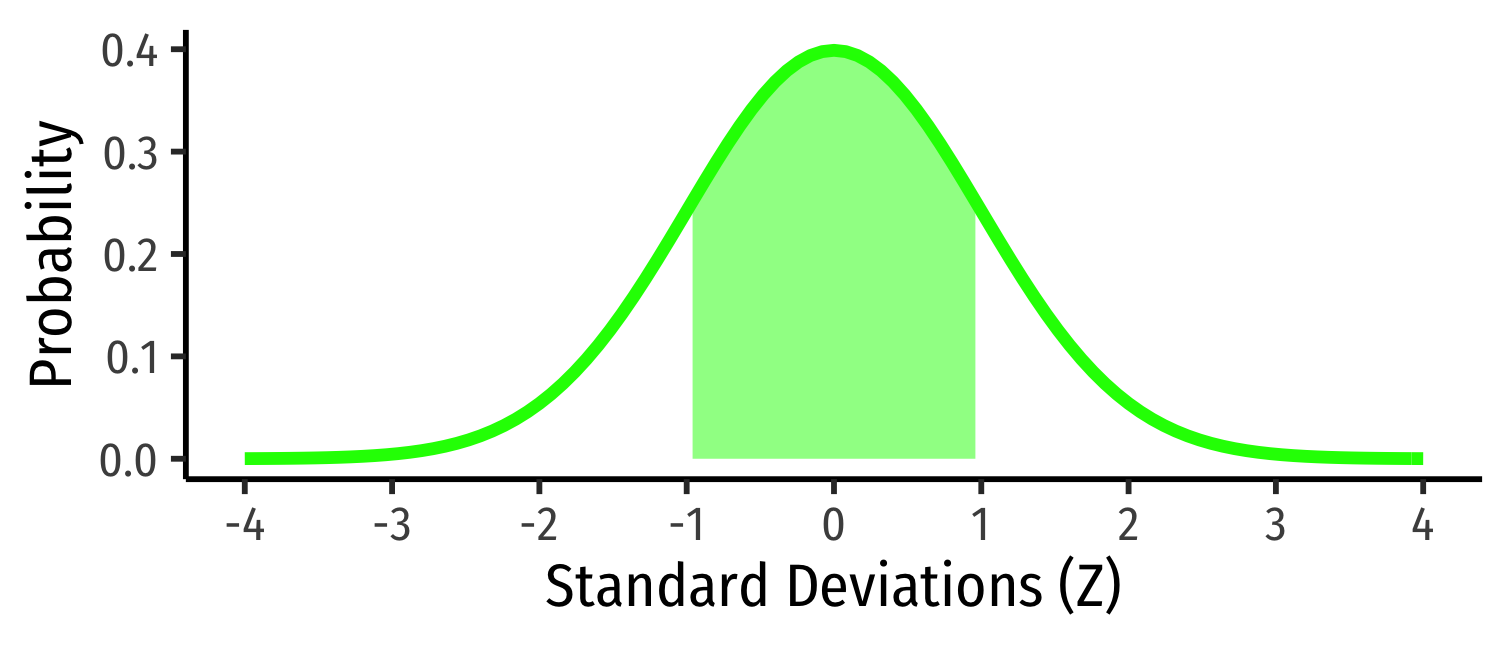

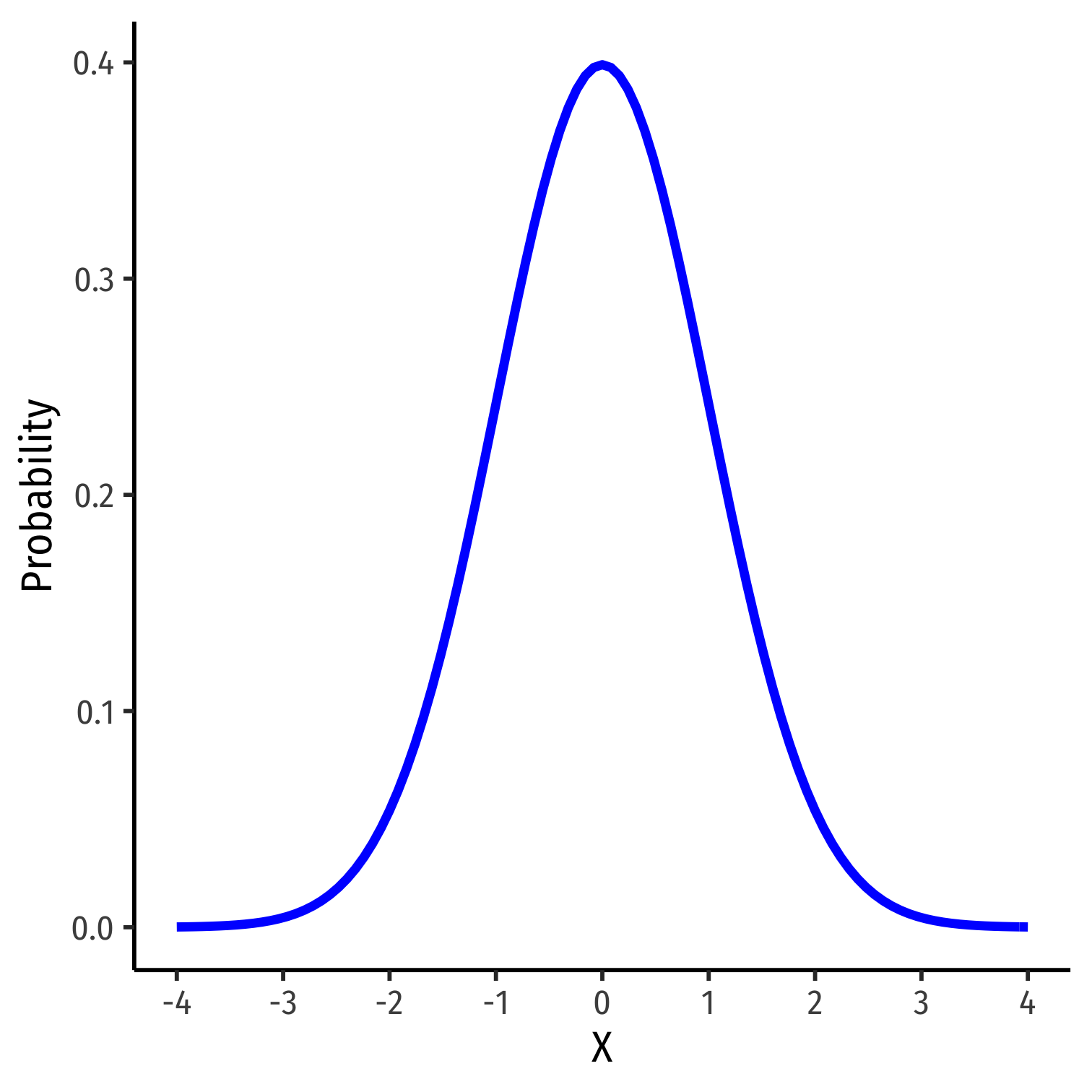

The Standard Normal Distribution

- The standard normal distribution (often referred to as Z) has mean 0 and standard deviation 1

Z∼N(0,1)

The Standard Normal cdf

- The standard normal cdf

Φ(k)=P(Z≤k)

Standardizing Variables

- We can take any normal distribution (for any μ,σ) and standardize it to the standard normal distribution by taking the Z-score of any value, xi:

Z=xi−μσ

Subtract any value by the distribution's mean and divide by standard deviation

Z: number of standard deviations xi value is away from the mean

Standardizing Variables: Example

Example: On August 8, 2011, the Dow dropped 634.8 points, sending shock waves through the financial community. Assume that during mid-2011 to mid-2012 the daily change for the Dow is normally distributed, with the mean daily change of 1.87 points and a standard deviation of 155.28 points. What is the Z-score?

Standardizing Variables: Example

Example: On August 8, 2011, the Dow dropped 634.8 points, sending shock waves through the financial community. Assume that during mid-2011 to mid-2012 the daily change for the Dow is normally distributed, with the mean daily change of 1.87 points and a standard deviation of 155.28 points. What is the Z-score?

Z=X−μσ

Standardizing Variables: Example

Example: On August 8, 2011, the Dow dropped 634.8 points, sending shock waves through the financial community. Assume that during mid-2011 to mid-2012 the daily change for the Dow is normally distributed, with the mean daily change of 1.87 points and a standard deviation of 155.28 points. What is the Z-score?

Z=X−μσ

Z=634.8−1.87155.28

Standardizing Variables: Example

Example: On August 8, 2011, the Dow dropped 634.8 points, sending shock waves through the financial community. Assume that during mid-2011 to mid-2012 the daily change for the Dow is normally distributed, with the mean daily change of 1.87 points and a standard deviation of 155.28 points. What is the Z-score?

Z=X−μσ

Z=634.8−1.87155.28

Z=−4.1

This is 4.1 standard deviations (σ) beneath the mean, an extremely low probability event.

Standardizing Variables: From X to Z I

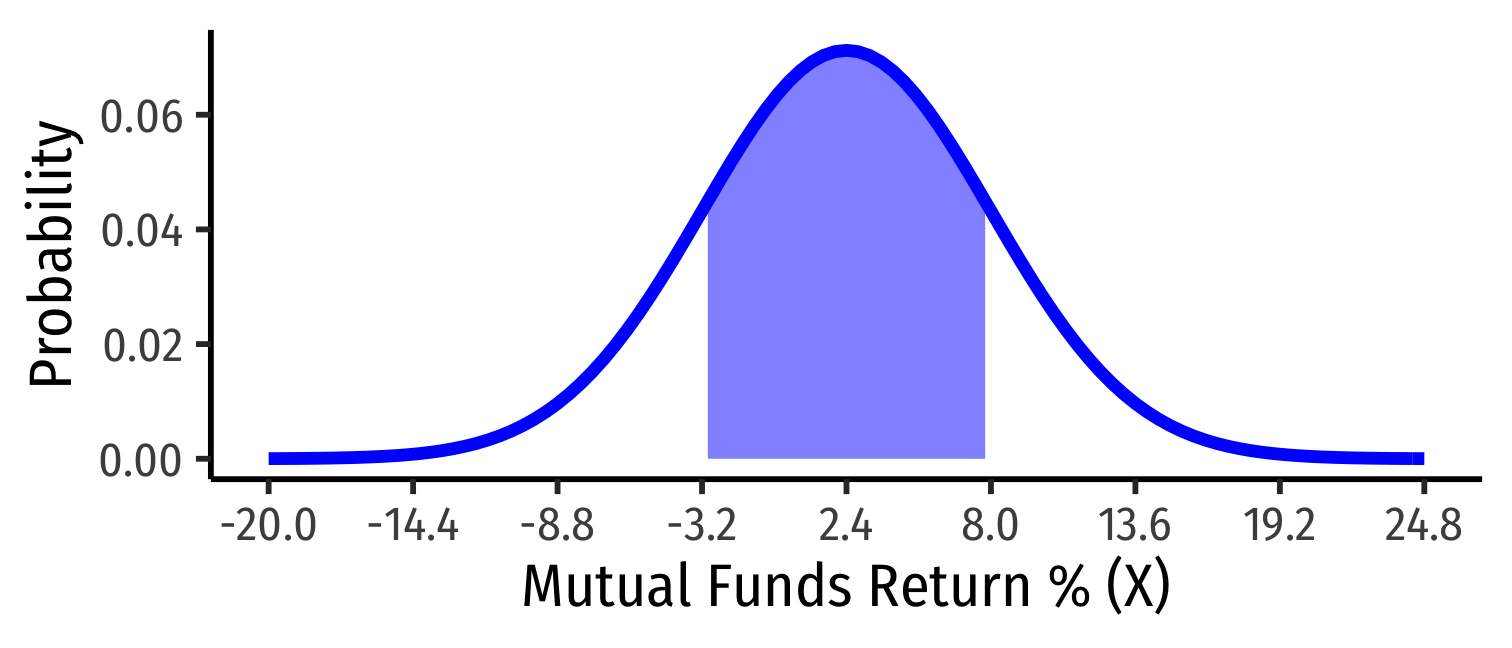

Example: In the last quarter of 2015, a group of 64 mutual funds had a mean return of 2.4% with a standard deviation of 5.6%. These returns can be approximated by a normal distribution.

What percent of the funds would you expect to be earning between -3.2% and 8.0% returns?

Standardizing Variables: From X to Z I

Example: In the last quarter of 2015, a group of 64 mutual funds had a mean return of 2.4% with a standard deviation of 5.6%. These returns can be approximated by a normal distribution.

What percent of the funds would you expect to be earning between -3.2% and 8.0% returns?

Convert to standard normal to find Z-scores for 8 and −3.2.

P(−3.2<X<8)

Standardizing Variables: From X to Z I

Example: In the last quarter of 2015, a group of 64 mutual funds had a mean return of 2.4% with a standard deviation of 5.6%. These returns can be approximated by a normal distribution.

What percent of the funds would you expect to be earning between -3.2% and 8.0% returns?

Convert to standard normal to find Z-scores for 8 and −3.2.

P(−3.2<X<8)

P(−3.2−2.45.6<X−2.45.6<8−2.45.6)

Standardizing Variables: From X to Z I

Example: In the last quarter of 2015, a group of 64 mutual funds had a mean return of 2.4% with a standard deviation of 5.6%. These returns can be approximated by a normal distribution.

What percent of the funds would you expect to be earning between -3.2% and 8.0% returns?

Convert to standard normal to find Z-scores for 8 and −3.2.

P(−3.2<X<8)

P(−3.2−2.45.6<X−2.45.6<8−2.45.6)

P(−1<Z<1)

Standardizing Variables: From X to Z I

Example: In the last quarter of 2015, a group of 64 mutual funds had a mean return of 2.4% with a standard deviation of 5.6%. These returns can be approximated by a normal distribution.

What percent of the funds would you expect to be earning between -3.2% and 8.0% returns?

Convert to standard normal to find Z-scores for 8 and −3.2.

P(−3.2<X<8)

P(−3.2−2.45.6<X−2.45.6<8−2.45.6)

P(−1<Z<1)

P(X±1σ)=0.68

Standardizing Variables: From X to Z II

Standardizing Variables: From X to Z III

You Try: In the last quarter of 2015, a group of 64 mutual funds had a mean return of 2.4% with a standard deviation of 5.6%. These returns can be approximated by a normal distribution.

What percent of the funds would you expect to be earning between -3.2% and 8.0% returns?

What percent of the funds would you expect to be earning 2.4% or less?

What percent of the funds would you expect to be earning between -8.8% and 13.6%?

What percent of the funds would you expect to be earning returns greater than 13.6%?

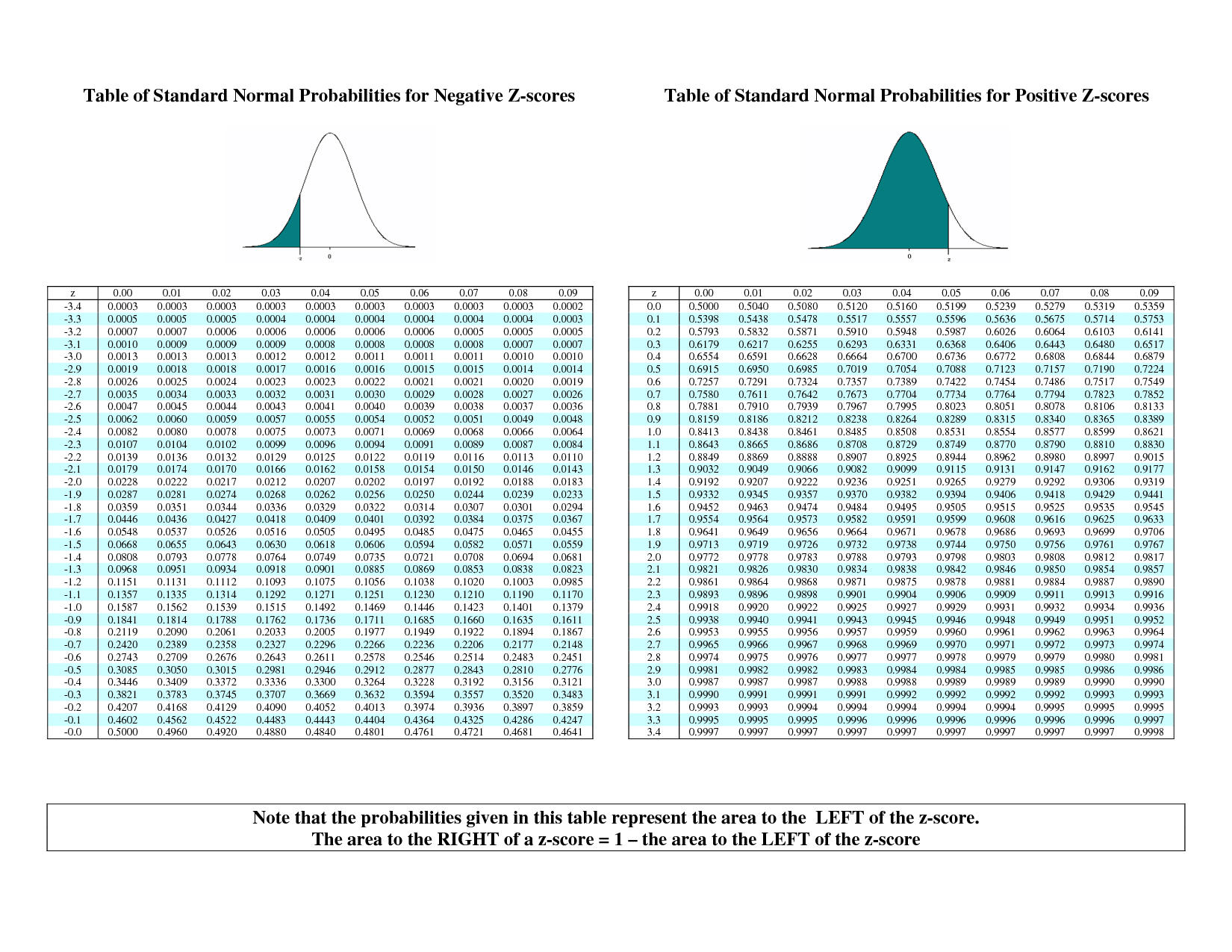

Finding Z-score Probabilities I

- How do we actually find the probabilities for Z−scores?

Finding Z-score Probabilities I

- How do we actually find the probabilities for Z−scores?

Finding Z-score Probabilities II

Probability to the left of zi

P(Z≤zi)=Φ(zi)⏟cdf of zi

Probability to the right of zi

P(Z≥zi)=1−Φ(zi)⏟cdf of zi

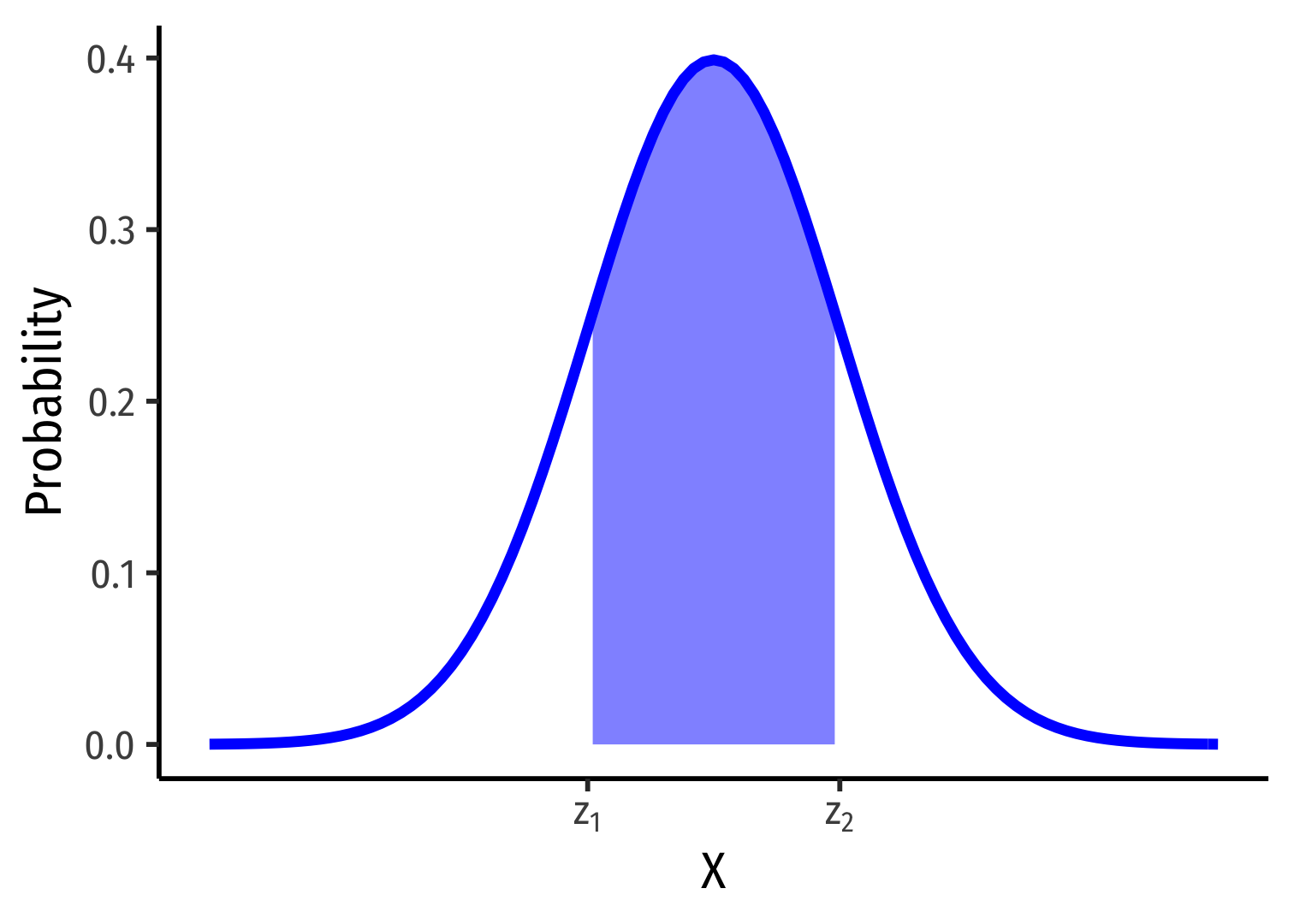

Finding Z-score Probabilities III

Probability between z1 and z2

P(z1≥Z≥z2)=Φ(z2)⏟cdf of z2−Φ(z1)⏟cdf of z1

Finding Z-score Probabilities IV

pnorm()calculatesprobabilities with anormal distribution with arguments:x =the valuemean =the meansd =the standard deviationlower.tail =TRUEif looking at area to LEFT of valueFALSEif looking at area to RIGHT of value

Finding Z-score Probabilities IV

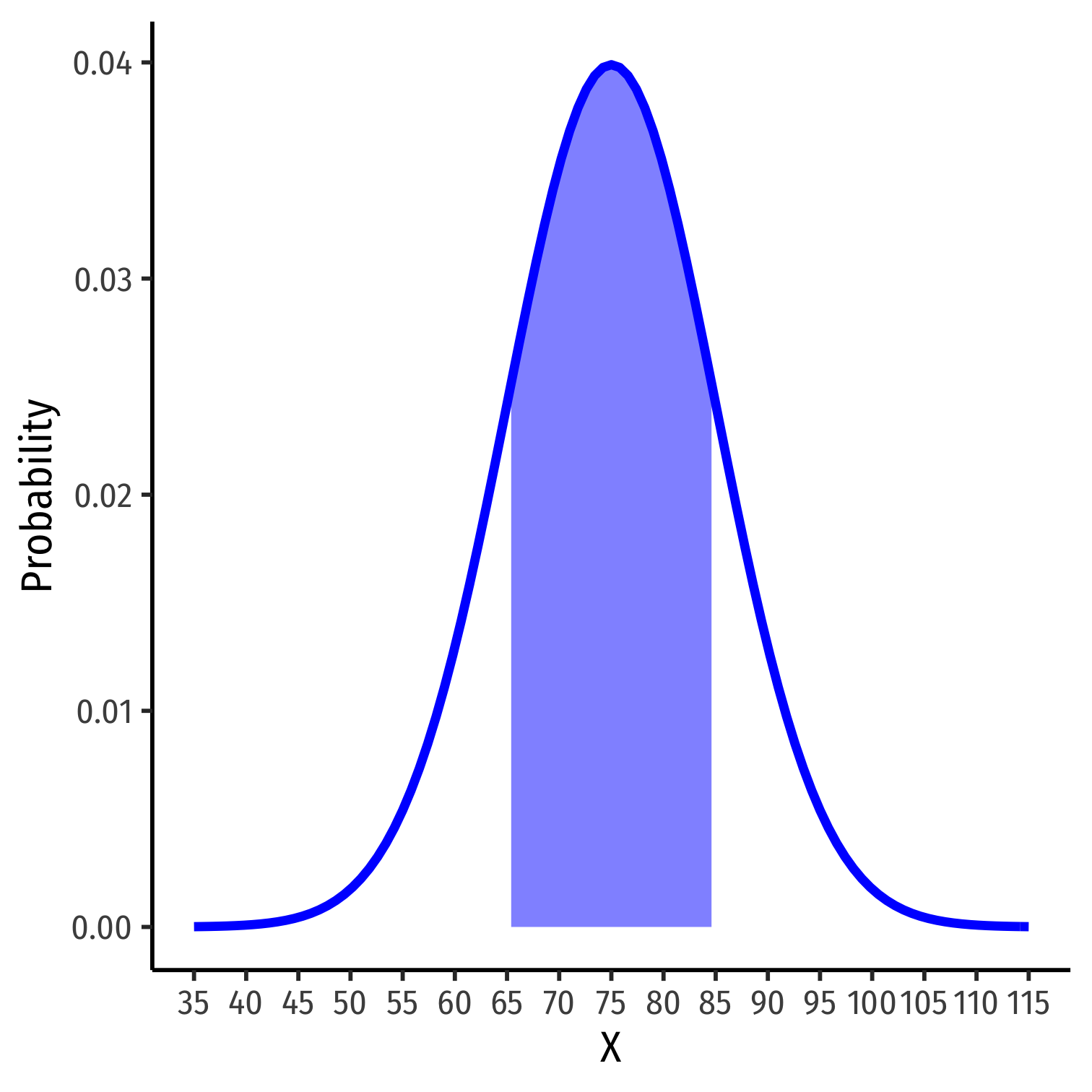

Example: Let the distribution of grades be normal, with mean 75 and standard deviation 10.

- Probability a student gets at least an 80

pnorm(80, mean = 75, sd = 10, lower.tail = FALSE) # looking to right## [1] 0.3085375

Finding Z-score Probabilities V

Example: Let the distribution of grades be normal, with mean 75 and standard deviation 10.

- Probability a student gets at most an 80

pnorm(80, mean = 75, sd = 10, lower.tail = TRUE) # looking to left## [1] 0.6914625

Finding Z-score Probabilities VI

Example: Let the distribution of grades be normal, with mean 75 and standard deviation 10.

- Probability a student gets between a 65 and 85

# subtract two left tails!pnorm(85, # larger number first! mean = 75, sd = 10, lower.tail = TRUE) - # looking to left, & SUBTRACT pnorm(65, # smaller number second! mean = 75, sd = 10, lower.tail = TRUE) #looking to left## [1] 0.6826895