3.9 — Logarithmic Regression

ECON 480 • Econometrics • Fall 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/metricsF21

metricsF21.classes.ryansafner.com

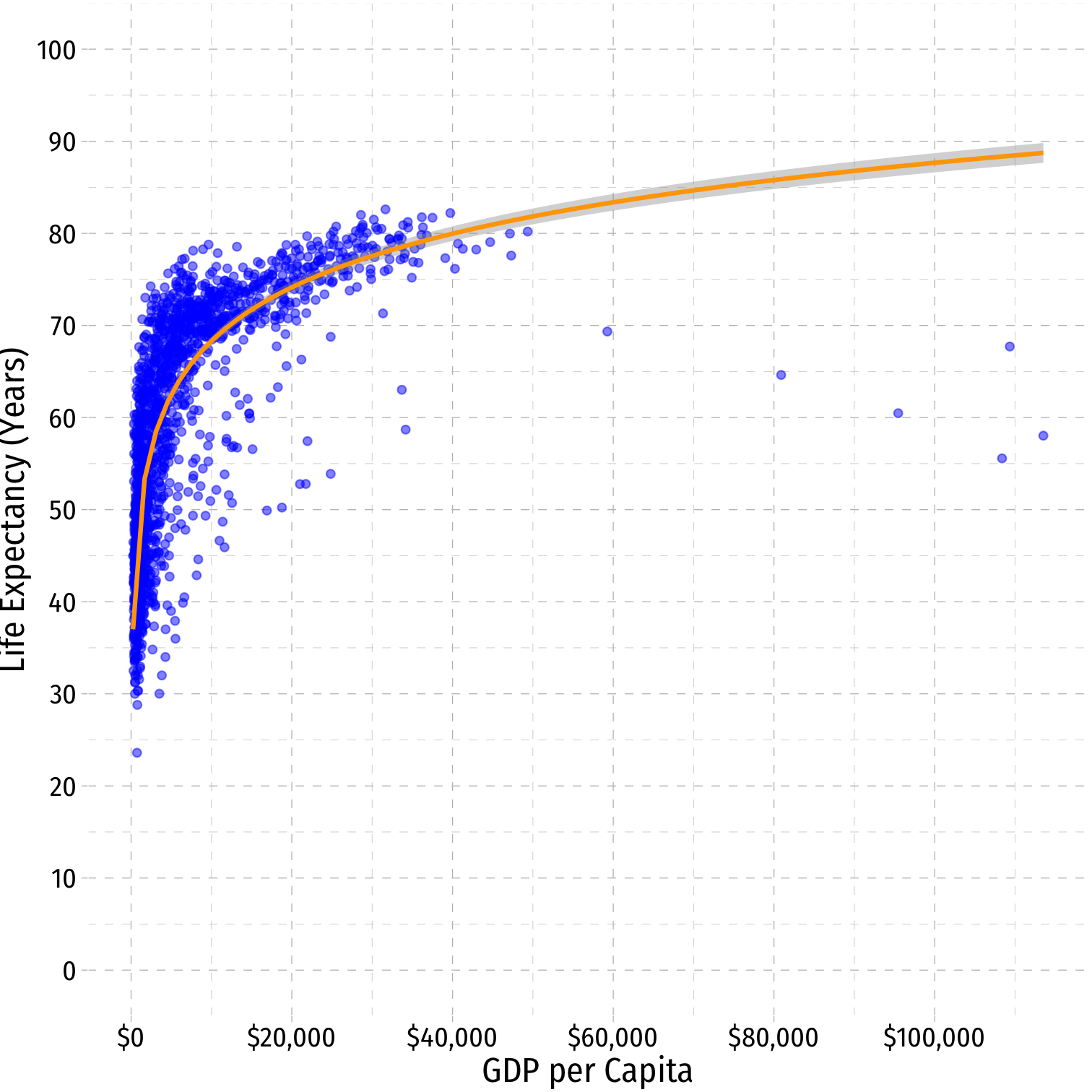

Nonlinearities

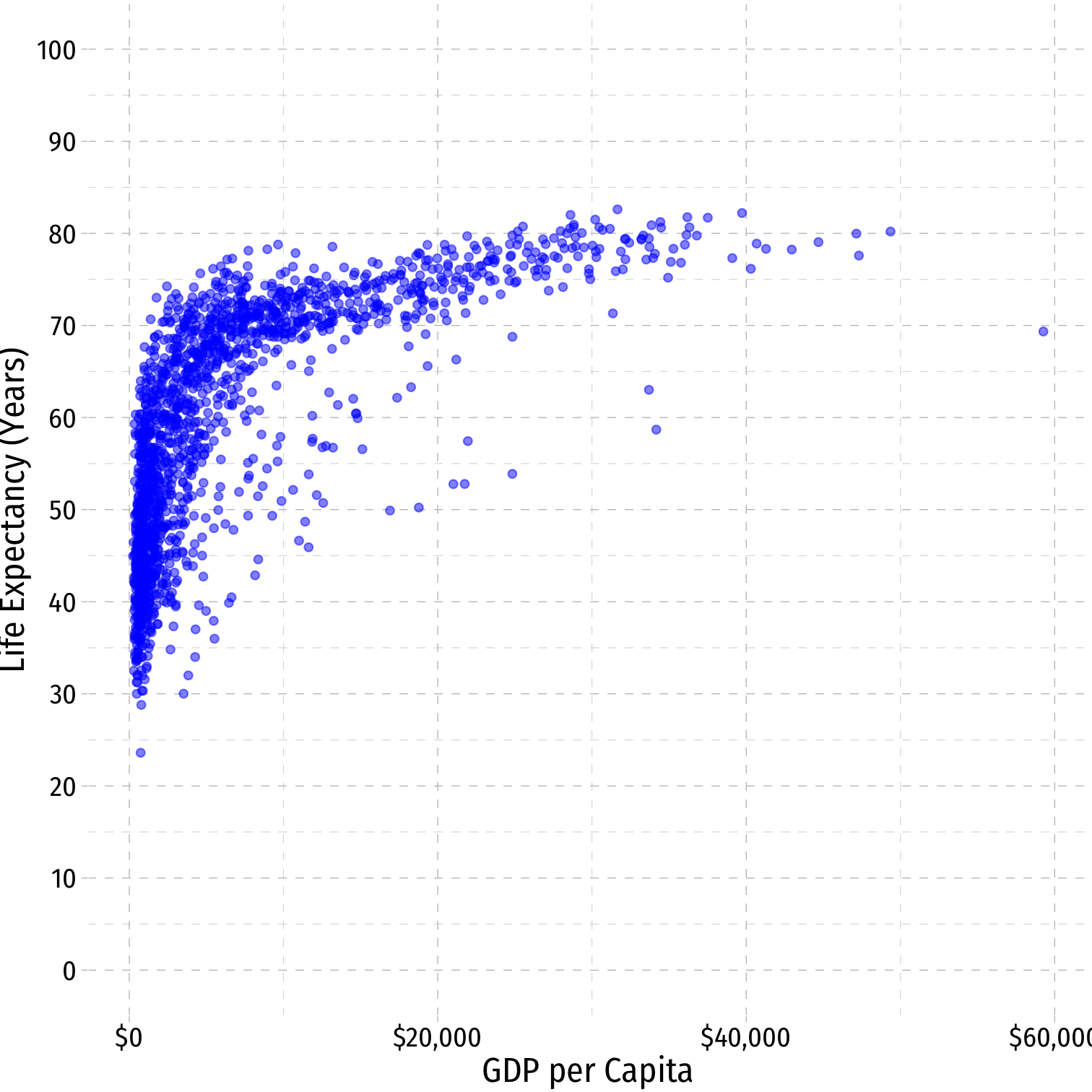

- Consider the

gapminderexample

Nonlinearities

- Consider the

gapminderexample

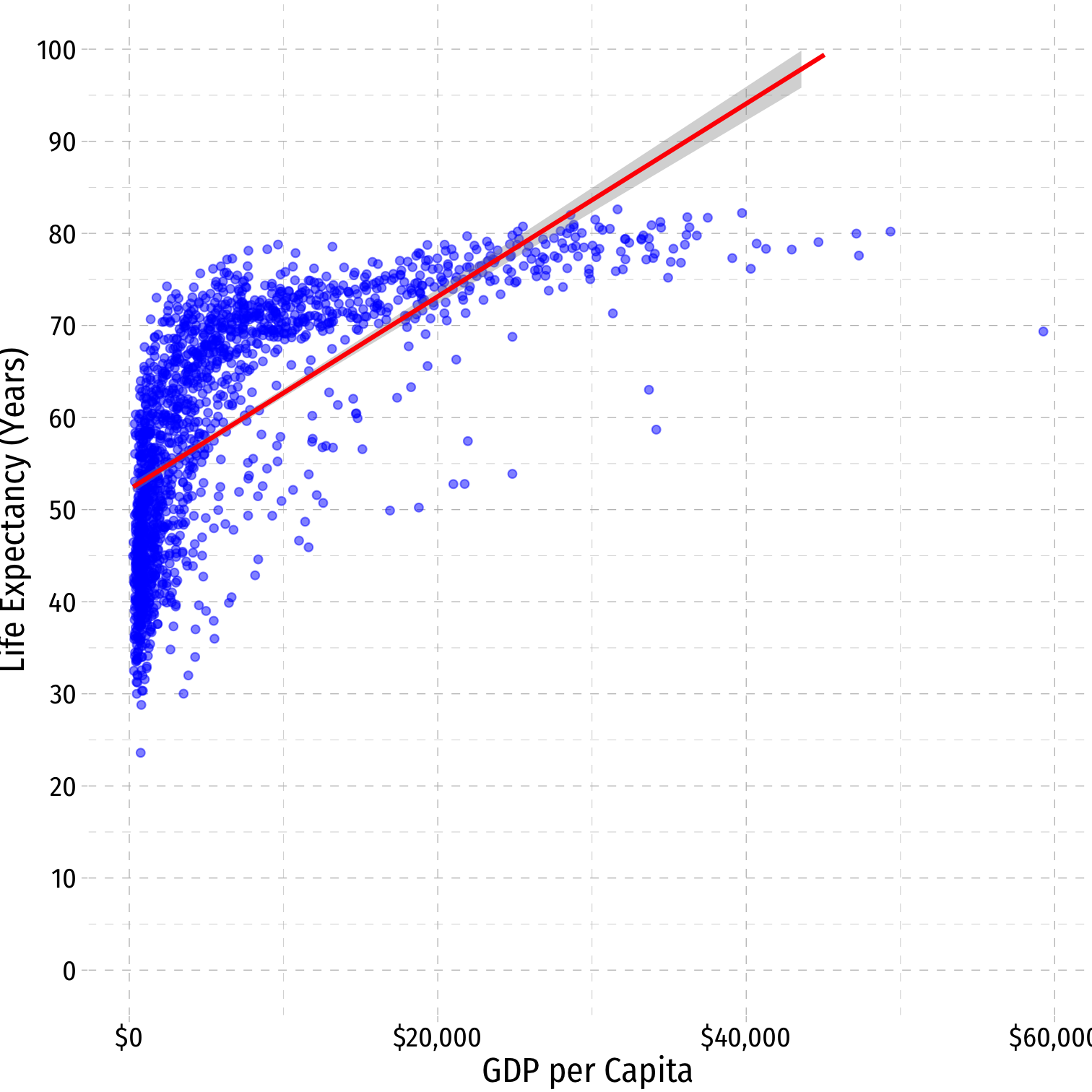

$$\color{red}{\widehat{\text{Life Expectancy}_i}=\hat{\beta_0}+\hat{\beta_1}\text{GDP}_i}$$

Nonlinearities

- Consider the

gapminderexample

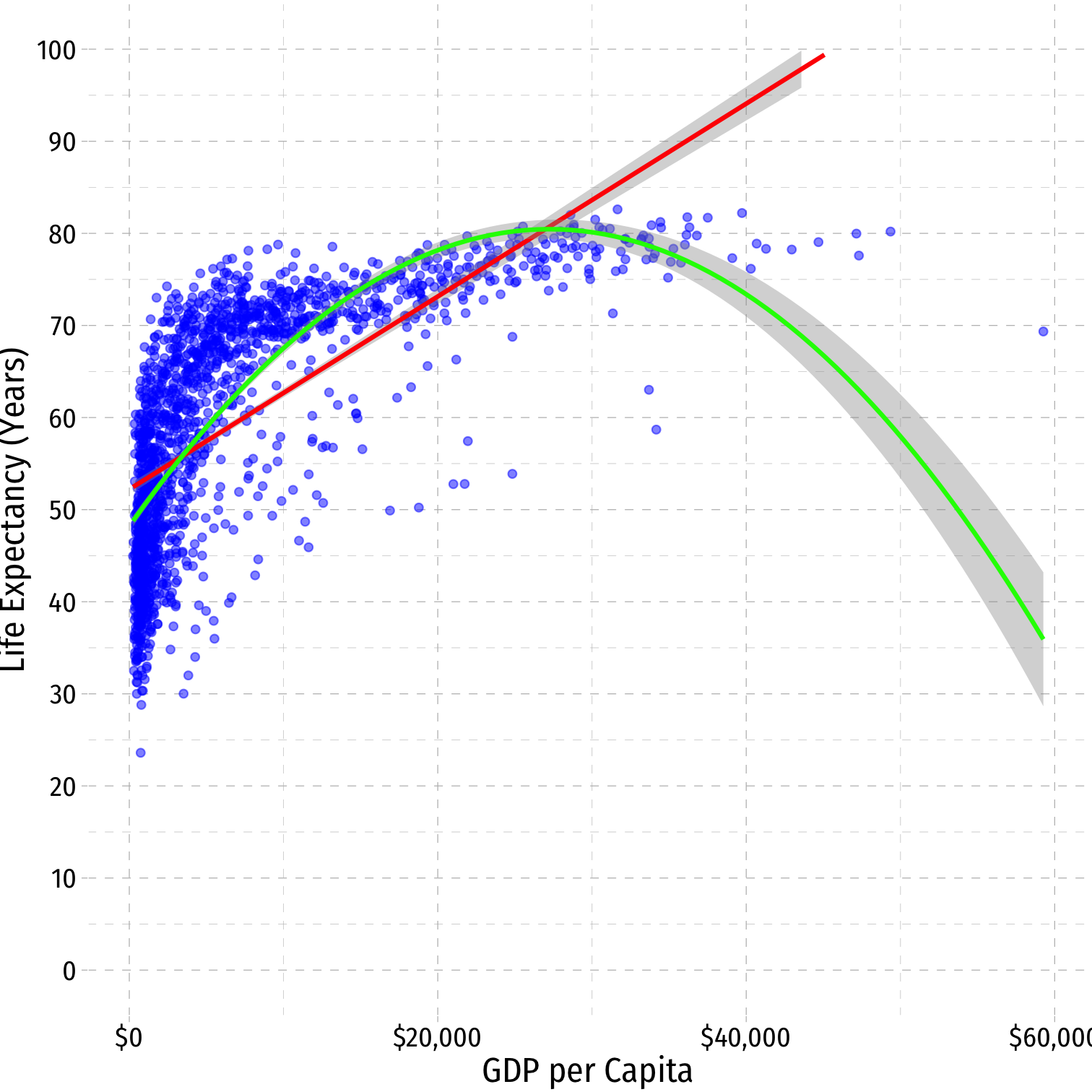

$$\color{red}{\widehat{\text{Life Expectancy}_i}=\hat{\beta_0}+\hat{\beta_1}\text{GDP}_i}$$

$$\color{green}{\widehat{\text{Life Expectancy}_i}=\hat{\beta_0}+\hat{\beta_1}\text{GDP}_i+\hat{\beta_2}\text{GDP}_i^2}$$

Nonlinearities

- Consider the

gapminderexample

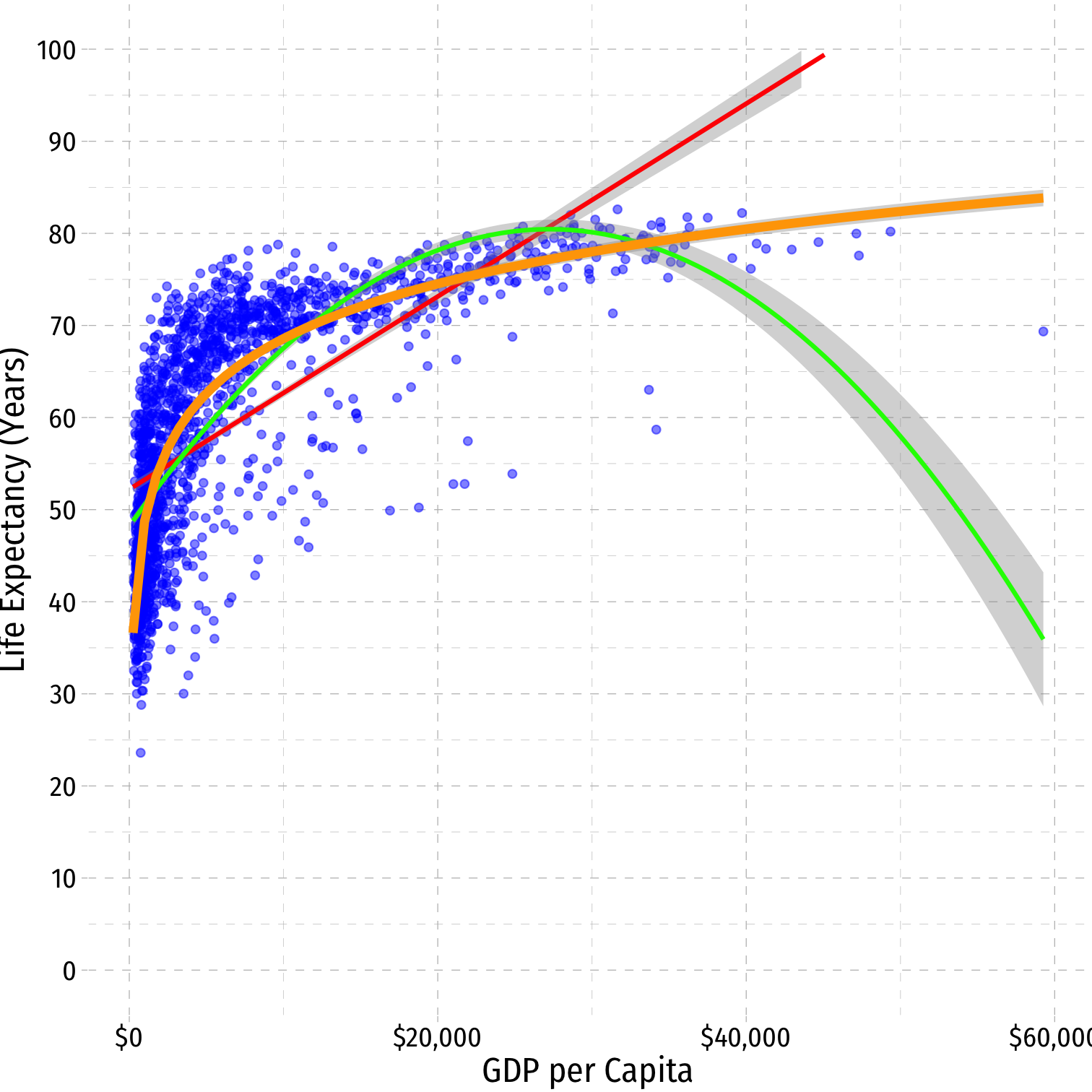

$$\color{red}{\widehat{\text{Life Expectancy}_i}=\hat{\beta_0}+\hat{\beta_1}\text{GDP}_i}$$

$$\color{green}{\widehat{\text{Life Expectancy}_i}=\hat{\beta_0}+\hat{\beta_1}\text{GDP}_i+\hat{\beta_2}\text{GDP}_i^2}$$

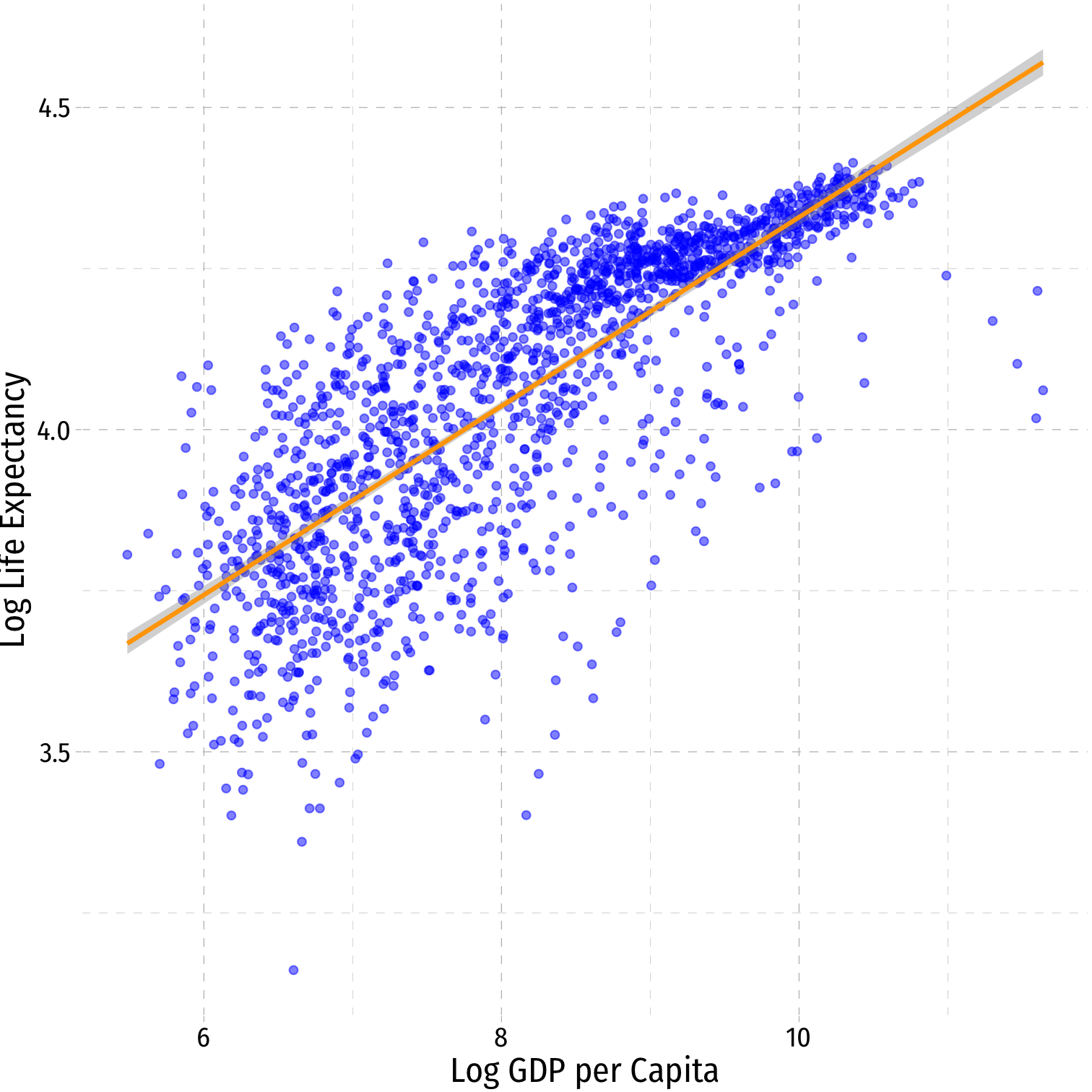

$$\color{orange}{\widehat{\text{Life Expectancy}_i}=\hat{\beta_0}+\hat{\beta_1}\ln \text{GDP}_i}$$

Natural Logarithms

Logarithmic Models

Another useful model for nonlinear data is the logarithmic model†

- We transform either \(X\), \(Y\), or both by taking the (natural) logarithm

Logarithmic model has two additional advantages

- We can easily interpret coefficients as percentage changes or elasticities

- Useful economic shape: diminishing returns (production functions, utility functions, etc)

† Don’t confuse this with a logistic (logit) model for dependent dummy variables.

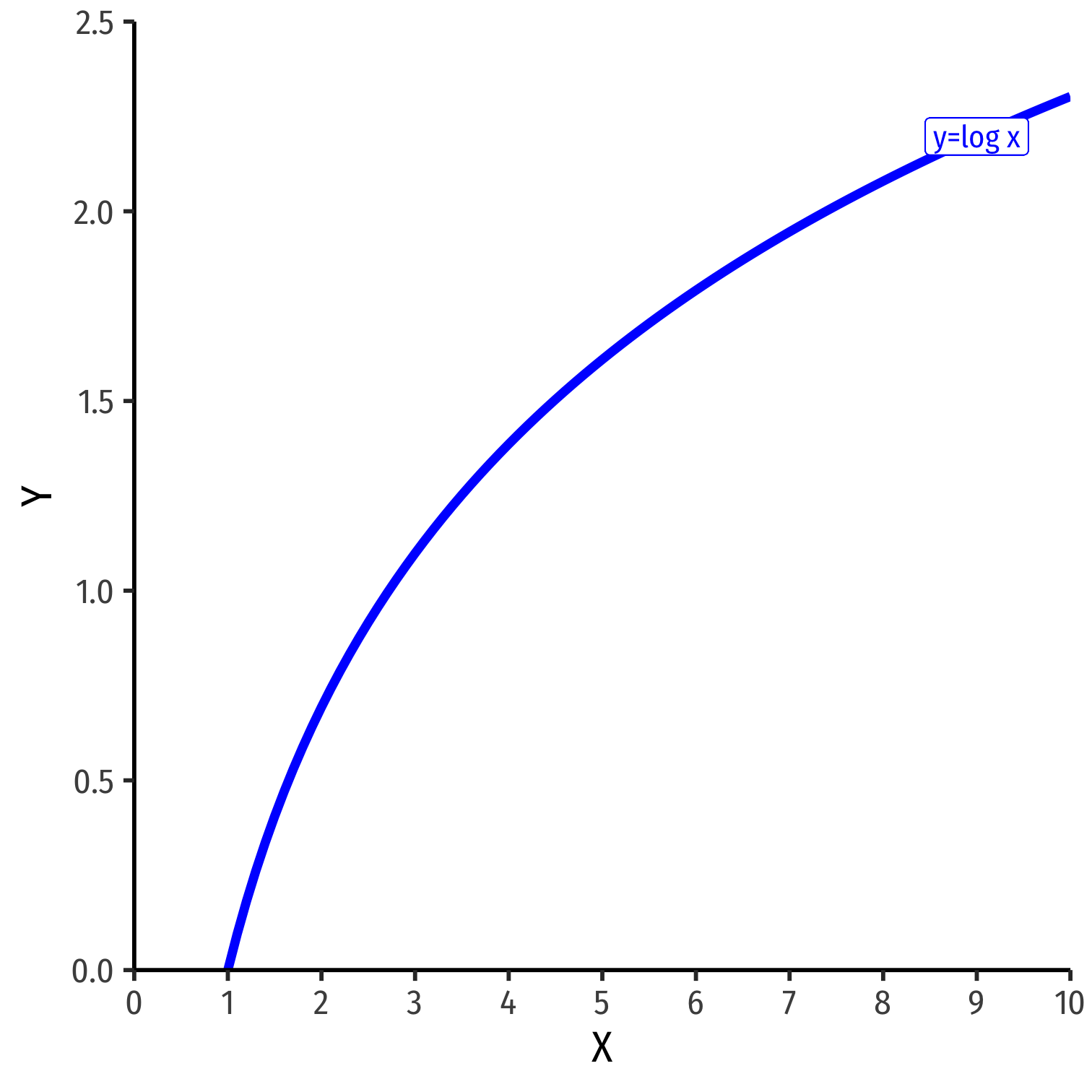

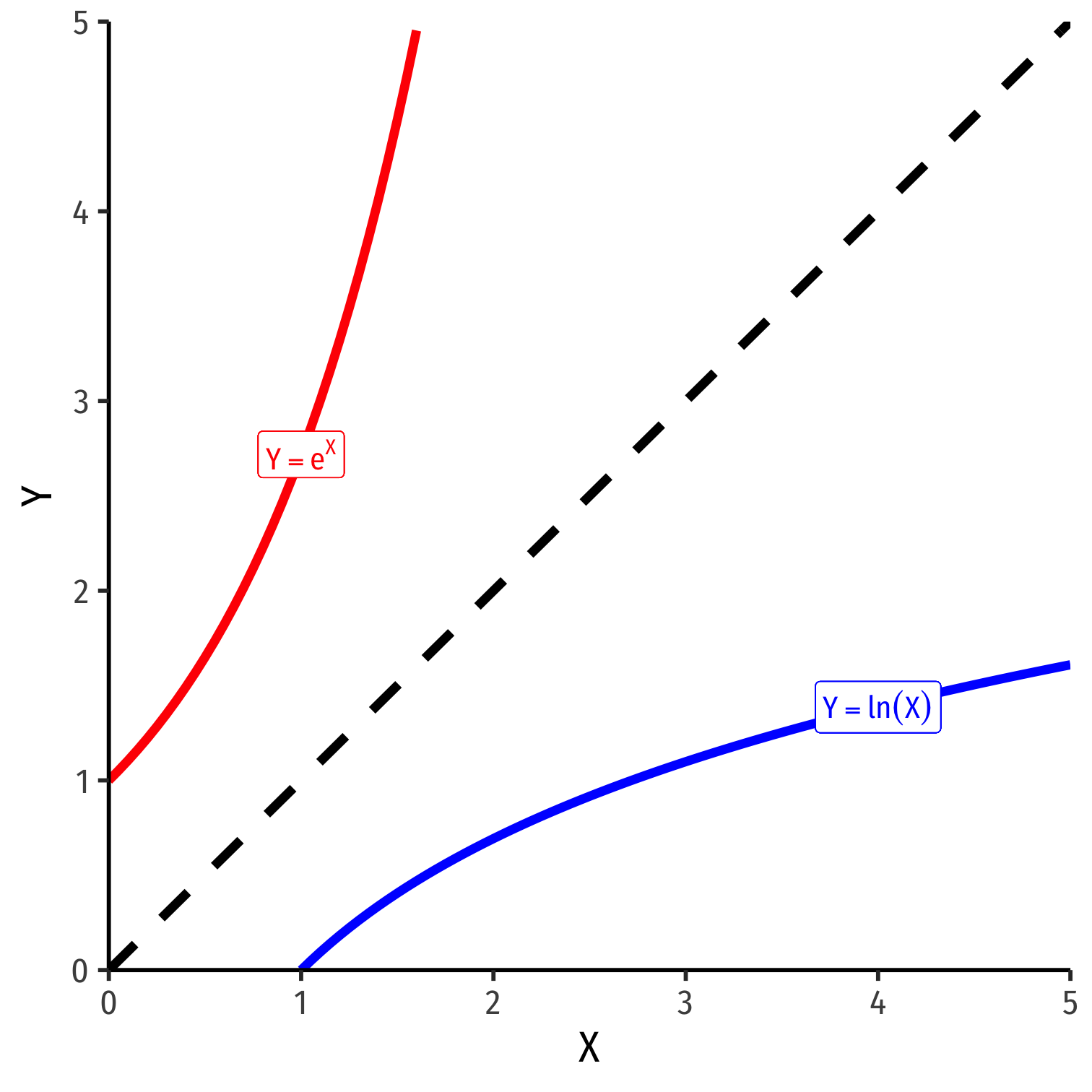

The Natural Logarithm

The exponential function, \(Y=e^X\) or \(Y=exp(X)\), where base \(e=2.71828...\)

Natural logarithm is the inverse, \(Y=ln(X)\)

The Natural Logarithm: Review I

- Exponents are defined as

$$\color{#6A5ACD}{b}^{\color{#e64173}{n}}=\underbrace{\color{#6A5ACD}{b} \times \color{#6A5ACD}{b} \times \cdots \times \color{#6A5ACD}{b}}_{\color{#e64173}{n} \text{ times}}$$

- where base \(\color{#6A5ACD}{b}\) is multiplied by itself \(\color{#e64173}{n}\) times

The Natural Logarithm: Review I

- Exponents are defined as

$$\color{#6A5ACD}{b}^{\color{#e64173}{n}}=\underbrace{\color{#6A5ACD}{b} \times \color{#6A5ACD}{b} \times \cdots \times \color{#6A5ACD}{b}}_{\color{#e64173}{n} \text{ times}}$$

- where base \(\color{#6A5ACD}{b}\) is multiplied by itself \(\color{#e64173}{n}\) times

- Example: \(\color{#6A5ACD}{2}^{\color{#e64173}{3}}=\underbrace{\color{#6A5ACD}{2} \times \color{#6A5ACD}{2} \times \color{#6A5ACD}{2}}_{\color{#e64173}{n=3}}=\color{#314f4f}{8}\)

The Natural Logarithm: Review I

- Exponents are defined as

$$\color{#6A5ACD}{b}^{\color{#e64173}{n}}=\underbrace{\color{#6A5ACD}{b} \times \color{#6A5ACD}{b} \times \cdots \times \color{#6A5ACD}{b}}_{\color{#e64173}{n} \text{ times}}$$

- where base \(\color{#6A5ACD}{b}\) is multiplied by itself \(\color{#e64173}{n}\) times

- Example: \(\color{#6A5ACD}{2}^{\color{#e64173}{3}}=\underbrace{\color{#6A5ACD}{2} \times \color{#6A5ACD}{2} \times \color{#6A5ACD}{2}}_{\color{#e64173}{n=3}}=\color{#314f4f}{8}\)

- Logarithms are the inverse, defined as the exponents in the expressions above

$$\text{If } \color{#6A5ACD}{b}^{\color{#e64173}{n}}=\color{#314f4f}{y}\text{, then }log_{\color{#6A5ACD}{b}}(\color{#314f4f}{y})=\color{#e64173}{n}$$

- \(\color{#e64173}{n}\) is the number you must raise \(\color{#6A5ACD}{b}\) to in order to get \(\color{#314f4f}{y}\)

The Natural Logarithm: Review I

- Exponents are defined as

$$\color{#6A5ACD}{b}^{\color{#e64173}{n}}=\underbrace{\color{#6A5ACD}{b} \times \color{#6A5ACD}{b} \times \cdots \times \color{#6A5ACD}{b}}_{\color{#e64173}{n} \text{ times}}$$

- where base \(\color{#6A5ACD}{b}\) is multiplied by itself \(\color{#e64173}{n}\) times

- Example: \(\color{#6A5ACD}{2}^{\color{#e64173}{3}}=\underbrace{\color{#6A5ACD}{2} \times \color{#6A5ACD}{2} \times \color{#6A5ACD}{2}}_{\color{#e64173}{n=3}}=\color{#314f4f}{8}\)

- Logarithms are the inverse, defined as the exponents in the expressions above

$$\text{If } \color{#6A5ACD}{b}^{\color{#e64173}{n}}=\color{#314f4f}{y}\text{, then }log_{\color{#6A5ACD}{b}}(\color{#314f4f}{y})=\color{#e64173}{n}$$

- \(\color{#e64173}{n}\) is the number you must raise \(\color{#6A5ACD}{b}\) to in order to get \(\color{#314f4f}{y}\)

- Example: \(log_{\color{#6A5ACD}{2}}(\color{#314f4f}{8})=\color{#e64173}{3}\)

The Natural Logarithm: Review II

- Logarithms can have any base, but common to use the natural logarithm \((\ln)\) with base \(\mathbf{e=2.71828...}\) $$\text{If } e^n=y\text{, then } \ln(y)=n$$

The Natural Logarithm: Properties

- Natural logs have a lot of useful properties:

\(\ln(\frac{1}{x})=-\ln(x)\)

\(\ln(ab)=\ln(a)+\ln(b)\)

\(\ln(\frac{x}{a})=\ln(x)-\ln(a)\)

\(\ln(x^a)=a \, \ln(x)\)

\(\frac{d \, \ln \, x}{d \, x} = \frac{1}{x}\)

The Natural Logarithm: Example

- Most useful property: for small change in \(x\), \(\Delta x\):

$$\underbrace{\ln(x+\Delta x) - \ln(x)}_{\text{Difference in logs}} \approx \underbrace{\frac{\Delta x}{x}}_{\text{Relative change}}$$

The Natural Logarithm: Example

- Most useful property: for small change in \(x\), \(\Delta x\):

$$\underbrace{\ln(x+\Delta x) - \ln(x)}_{\text{Difference in logs}} \approx \underbrace{\frac{\Delta x}{x}}_{\text{Relative change}}$$

Example: Let \(x=100\) and \(\Delta x =1\), relative change is:

$$\frac{\Delta x}{x} = \frac{(101-100)}{100} = 0.01 \text{ or }1\%$$

- The logged difference: $$\ln(101)-\ln(100) = 0.00995 \approx 1\%$$

The Natural Logarithm: Example

- Most useful property: for small change in \(x\), \(\Delta x\):

$$\underbrace{\ln(x+\Delta x) - \ln(x)}_{\text{Difference in logs}} \approx \underbrace{\frac{\Delta x}{x}}_{\text{Relative change}}$$

Example: Let \(x=100\) and \(\Delta x =1\), relative change is:

$$\frac{\Delta x}{x} = \frac{(101-100)}{100} = 0.01 \text{ or }1\%$$

- The logged difference: $$\ln(101)-\ln(100) = 0.00995 \approx 1\%$$

- This allows us to very easily interpret coefficients as percent changes or elasticities

Elasticity

- An elasticity between any two variables, \(\epsilon_{Y,X}\) describes the responsiveness (in %) of one variable \((Y)\) to a change in another \((X)\)

Elasticity

- An elasticity between any two variables, \(\epsilon_{Y,X}\) describes the responsiveness (in %) of one variable \((Y)\) to a change in another \((X)\)

$$\epsilon_{Y,X}=\frac{\% \Delta Y}{\% \Delta X} =\cfrac{\left(\frac{\Delta Y}{Y}\right)}{\left( \frac{\Delta X}{X}\right)}$$

Elasticity

- An elasticity between any two variables, \(\epsilon_{Y,X}\) describes the responsiveness (in %) of one variable \((Y)\) to a change in another \((X)\)

$$\epsilon_{Y,X}=\frac{\% \Delta Y}{\% \Delta X} =\cfrac{\left(\frac{\Delta Y}{Y}\right)}{\left( \frac{\Delta X}{X}\right)}$$

- Numerator is relative change in \(Y\), Denominator is relative change in \(X\)

Elasticity

- An elasticity between any two variables, \(\epsilon_{Y,X}\) describes the responsiveness (in %) of one variable \((Y)\) to a change in another \((X)\)

$$\epsilon_{Y,X}=\frac{\% \Delta Y}{\% \Delta X} =\cfrac{\left(\frac{\Delta Y}{Y}\right)}{\left( \frac{\Delta X}{X}\right)}$$

- Numerator is relative change in \(Y\), Denominator is relative change in \(X\)

- Interpretation: a 1% change in \(X\) will cause a \(\epsilon_{Y,X}\)% chang in \(Y\)

Math FYI: Cobb Douglas Functions and Logs

- One of the (many) reasons why economists love Cobb-Douglas functions: $$Y=AL^{\alpha}K^{\beta}$$

Math FYI: Cobb Douglas Functions and Logs

One of the (many) reasons why economists love Cobb-Douglas functions: $$Y=AL^{\alpha}K^{\beta}$$

Taking logs, relationship becomes linear:

Math FYI: Cobb Douglas Functions and Logs

One of the (many) reasons why economists love Cobb-Douglas functions: $$Y=AL^{\alpha}K^{\beta}$$

Taking logs, relationship becomes linear:

$$\ln(Y)=\ln(A)+\alpha \ln(L)+ \beta \ln(K)$$

Math FYI: Cobb Douglas Functions and Logs

One of the (many) reasons why economists love Cobb-Douglas functions: $$Y=AL^{\alpha}K^{\beta}$$

Taking logs, relationship becomes linear:

$$\ln(Y)=\ln(A)+\alpha \ln(L)+ \beta \ln(K)$$

- With data on \((Y, L, K)\) and linear regression, can estimate \(\alpha\) and \(\beta\)

- \(\alpha\): elasticity of \(Y\) with respect to \(L\)

- A 1% change in \(L\) will lead to an \(\alpha\)% change in \(Y\)

- \(\beta\): elasticity of \(Y\) with respect to \(K\)

- A 1% change in \(K\) will lead to a \(\beta\)% change in \(Y\)

- \(\alpha\): elasticity of \(Y\) with respect to \(L\)

Math FYI: Cobb Douglas Functions and Logs

Example: Cobb-Douglas production function: $$Y=2L^{0.75}K^{0.25}$$

Math FYI: Cobb Douglas Functions and Logs

Example: Cobb-Douglas production function: $$Y=2L^{0.75}K^{0.25}$$

- Taking logs:

$$\ln Y=\ln 2+0.75 \ln L + 0.25 \ln K$$

Math FYI: Cobb Douglas Functions and Logs

Example: Cobb-Douglas production function: $$Y=2L^{0.75}K^{0.25}$$

- Taking logs:

$$\ln Y=\ln 2+0.75 \ln L + 0.25 \ln K$$

A 1% change in \(L\) will yield a 0.75% change in output \(Y\)

A 1% change in \(K\) will yield a 0.25% change in output \(Y\)

Logarithms in R I

- The

log()function can easily take the logarithm

gapminder <- gapminder %>% mutate(loggdp = log(gdpPercap)) # log GDP per capitagapminder %>% head() # look at itLogarithms in R II

- Note,

log()by default is the natural logarithm \(ln()\), i.e. basee- Can change base with e.g.

log(x, base = 5) - Some common built-in logs:

log10,log2

- Can change base with e.g.

log10(100)## [1] 2log2(16)## [1] 4log(19683, base=3)## [1] 9Logarithms in R III

- Note when running a regression, you can pre-transform the data into logs (as I did above), or just add

log()around a variable in the regression

lm(lifeExp ~ loggdp, data = gapminder) %>% tidy()lm(lifeExp ~ log(gdpPercap), data = gapminder) %>% tidy()Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

- Linear-log model: \(Y_i=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\)

Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

Linear-log model: \(Y_i=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\)

Log-linear model: \(\color{#e64173}{\ln Y_i}=\beta_0+\beta_1X_i\)

Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

Linear-log model: \(Y_i=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\)

Log-linear model: \(\color{#e64173}{\ln Y_i}=\beta_0+\beta_1X_i\)

Log-log model: \(\color{#e64173}{\ln Y_i}=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\)

Linear-Log Model

Linear-Log Model

- Linear-log model has an independent variable \((X)\) that is logged

Linear-Log Model

- Linear-log model has an independent variable \((X)\) that is logged

$$\begin{align*} Y&=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\\ \beta_1&=\cfrac{\Delta Y}{\big(\frac{\Delta X}{X}\big)}\\ \end{align*}$$

Linear-Log Model

- Linear-log model has an independent variable \((X)\) that is logged

$$\begin{align*} Y&=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\\ \beta_1&=\cfrac{\Delta Y}{\big(\frac{\Delta X}{X}\big)}\\ \end{align*}$$

- Marginal effect of \(\mathbf{X \rightarrow Y}\): a 1% change in \(X \rightarrow\) a \(\frac{\beta_1}{100}\) unit change in \(Y\)

Linear-Log Model in R

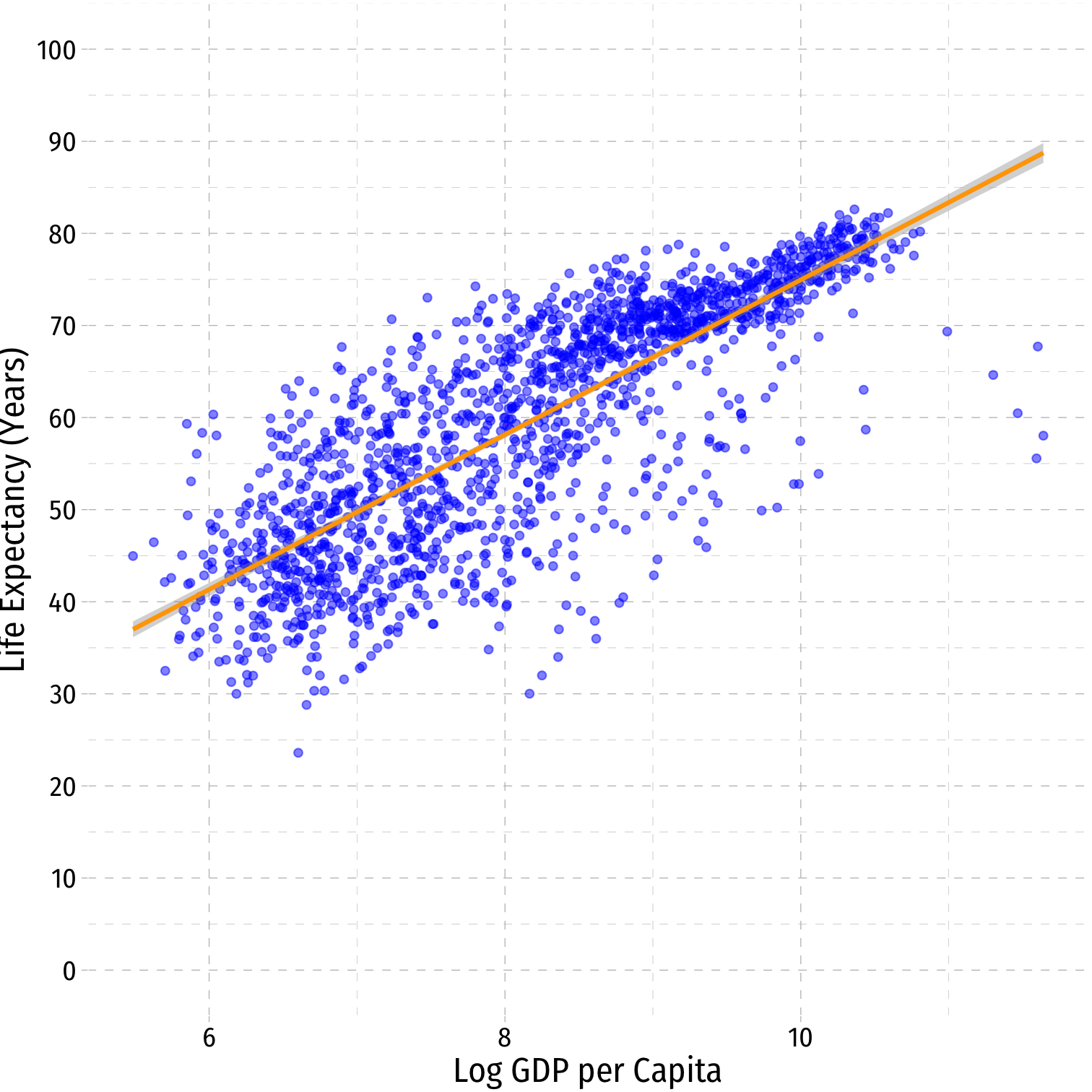

lin_log_reg <- lm(lifeExp ~ loggdp, data = gapminder)library(broom)lin_log_reg %>% tidy()$$\widehat{\text{Life Expectancy}}_i=-9.10+8.41 \, \text{ln GDP}_i$$

Linear-Log Model in R

lin_log_reg <- lm(lifeExp ~ loggdp, data = gapminder)library(broom)lin_log_reg %>% tidy()$$\widehat{\text{Life Expectancy}}_i=-9.10+8.41 \, \text{ln GDP}_i$$

- A 1% change in GDP \(\rightarrow\) a \(\frac{9.41}{100}=\) 0.0841 year increase in Life Expectancy

Linear-Log Model in R

lin_log_reg <- lm(lifeExp ~ loggdp, data = gapminder)library(broom)lin_log_reg %>% tidy()$$\widehat{\text{Life Expectancy}}_i=-9.10+8.41 \, \text{ln GDP}_i$$

A 1% change in GDP \(\rightarrow\) a \(\frac{9.41}{100}=\) 0.0841 year increase in Life Expectancy

A 25% fall in GDP \(\rightarrow\) a \((-25 \times 0.0841)=\) 2.1025 year decrease in Life Expectancy

Linear-Log Model in R

lin_log_reg <- lm(lifeExp ~ loggdp, data = gapminder)library(broom)lin_log_reg %>% tidy()$$\widehat{\text{Life Expectancy}}_i=-9.10+8.41 \, \text{ln GDP}_i$$

A 1% change in GDP \(\rightarrow\) a \(\frac{9.41}{100}=\) 0.0841 year increase in Life Expectancy

A 25% fall in GDP \(\rightarrow\) a \((-25 \times 0.0841)=\) 2.1025 year decrease in Life Expectancy

A 100% rise in GDP \(\rightarrow\) a \((100 \times 0.0841)=\) 8.4100 year increase in Life Expectancy

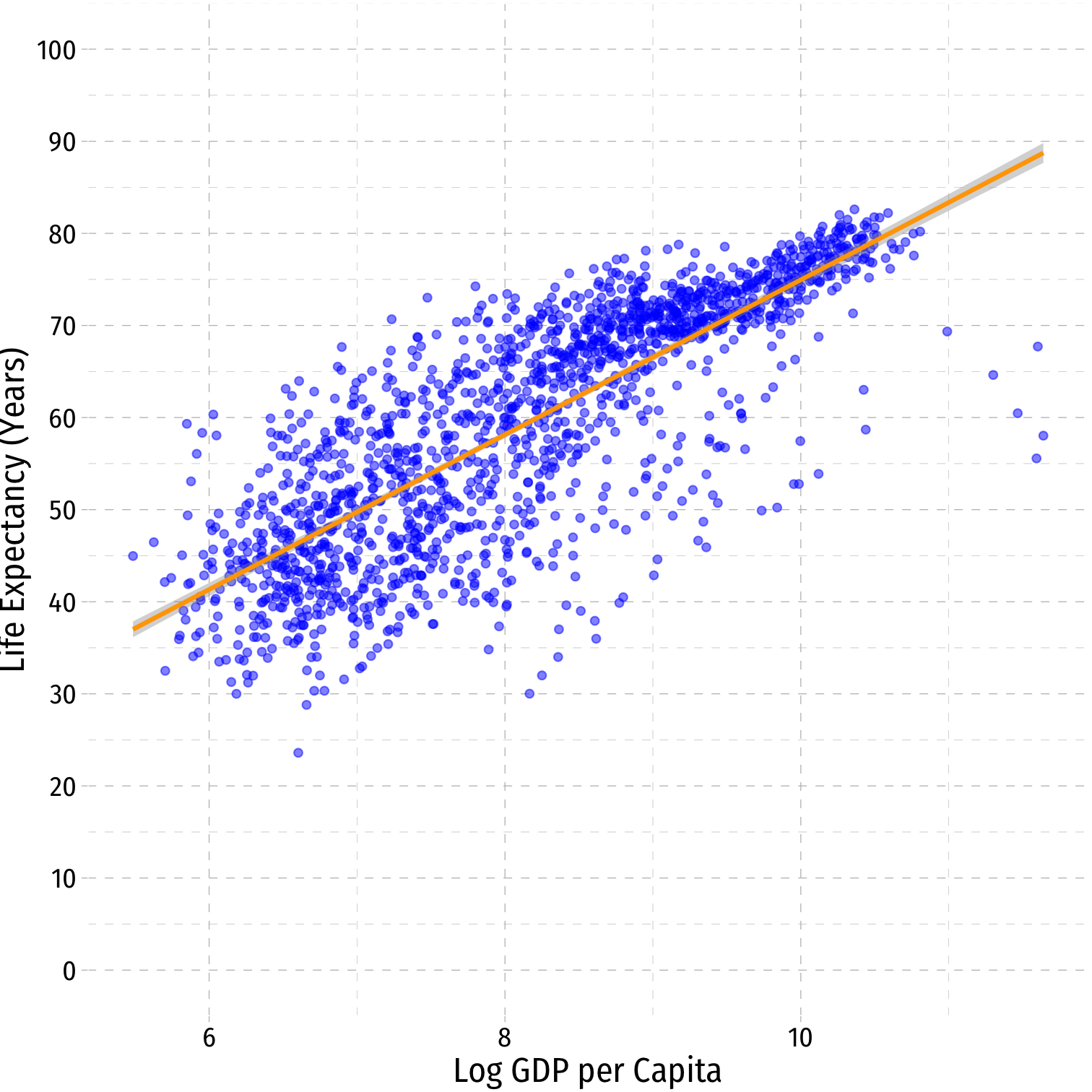

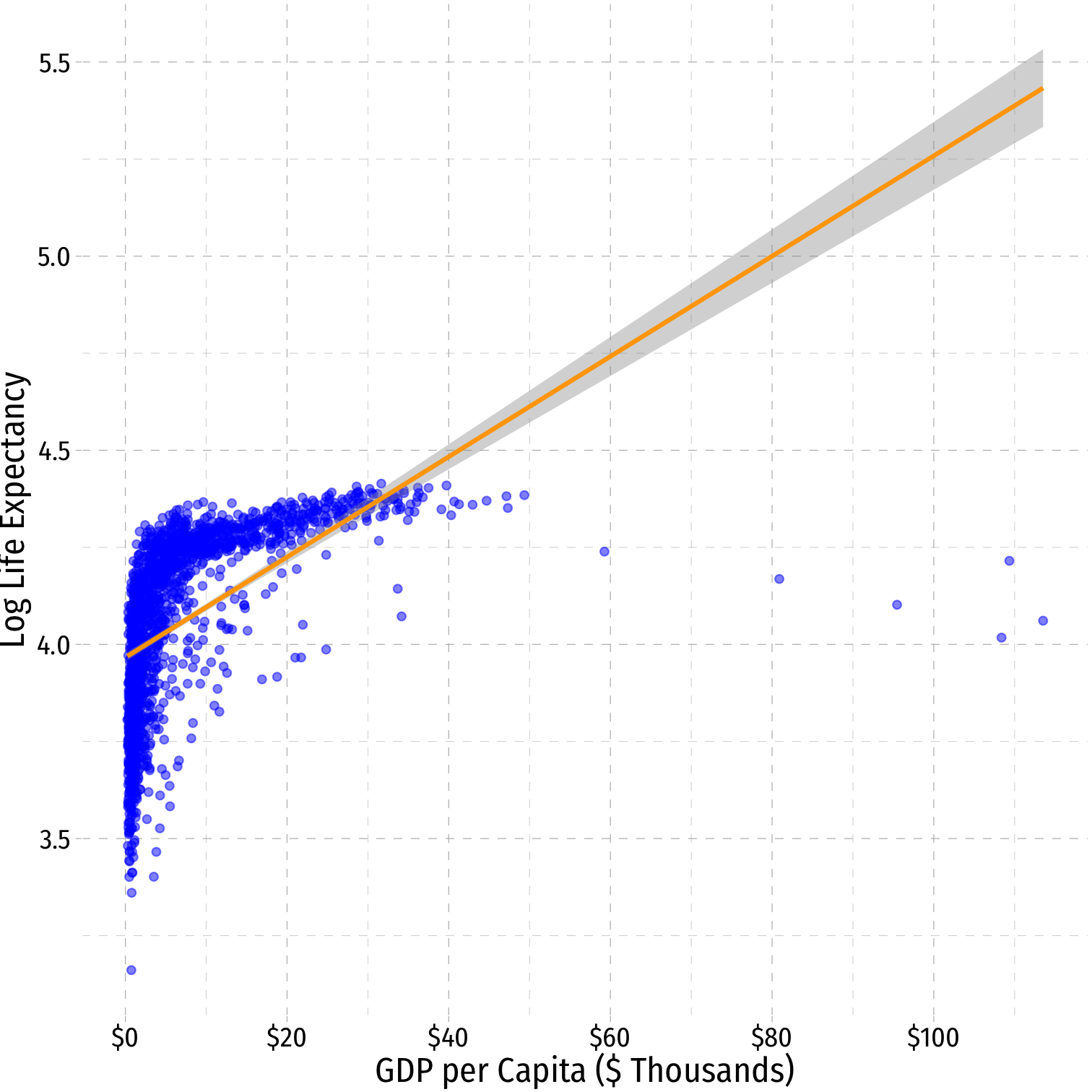

Linear-Log Model Graph I

ggplot(data = gapminder)+ aes(x = gdpPercap, y = lifeExp)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", formula=y~log(x), color="orange")+ scale_x_continuous(labels=scales::dollar, breaks=seq(0,120000,20000))+ scale_y_continuous(breaks=seq(0,100,10), limits=c(0,100))+ labs(x = "GDP per Capita", y = "Life Expectancy (Years)")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)

Linear-Log Model Graph II

ggplot(data = gapminder)+ aes(x = loggdp, y = lifeExp)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", color="orange")+ scale_y_continuous(breaks=seq(0,100,10), limits=c(0,100))+ labs(x = "Log GDP per Capita", y = "Life Expectancy (Years)")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)

Log-Linear Model

Log-Linear Model

- Log-linear model has the dependent variable \((Y)\) logged

Log-Linear Model

- Log-linear model has the dependent variable \((Y)\) logged

$$\begin{align*} \color{#e64173}{\ln Y_i}&=\beta_0+\beta_1 X\\ \beta_1&=\cfrac{\big(\frac{\Delta Y}{Y}\big)}{\Delta X}\\ \end{align*}$$

Log-Linear Model

- Log-linear model has the dependent variable \((Y)\) logged

$$\begin{align*} \color{#e64173}{\ln Y_i}&=\beta_0+\beta_1 X\\ \beta_1&=\cfrac{\big(\frac{\Delta Y}{Y}\big)}{\Delta X}\\ \end{align*}$$

- Marginal effect of \(\mathbf{X \rightarrow Y}\): a 1 unit change in \(X \rightarrow\) a \(\beta_1 \times 100\) % change in \(Y\)

Log-Linear Model in R (Preliminaries)

We will again have very large/small coefficients if we deal with GDP directly, again let's transform

gdpPercapinto $1,000s, call itgdp_tThen log LifeExp

Log-Linear Model in R (Preliminaries)

We will again have very large/small coefficients if we deal with GDP directly, again let's transform

gdpPercapinto $1,000s, call itgdp_tThen log LifeExp

gapminder <- gapminder %>% mutate(gdp_t = gdpPercap/1000, # first make GDP/capita in $1000s loglife = log(lifeExp)) # take the log of LifeExpgapminder %>% head() # look at itLog-Linear Model in R

log_lin_reg <- lm(loglife~gdp_t, data = gapminder)log_lin_reg %>% tidy()$$\widehat{\ln\text{Life Expectancy}}_i=3.967+0.013 \, \text{GDP}_i$$

Log-Linear Model in R

log_lin_reg <- lm(loglife~gdp_t, data = gapminder)log_lin_reg %>% tidy()$$\widehat{\ln\text{Life Expectancy}}_i=3.967+0.013 \, \text{GDP}_i$$

- A $1 (thousand) change in GDP \(\rightarrow\) a \(0.013 \times 100\%=\) 1.3% increase in Life Expectancy

Log-Linear Model in R

log_lin_reg <- lm(loglife~gdp_t, data = gapminder)log_lin_reg %>% tidy()$$\widehat{ln(\text{Life Expectancy})}_i=3.967+0.013 \, \text{GDP}_i$$

A $1 (thousand) change in GDP \(\rightarrow\) a \(0.013 \times 100\%=\) 1.3% increase in Life Expectancy

A $25 (thousand) fall in GDP \(\rightarrow\) a \((-25 \times 1.3\%)=\) 32.5% decrease in Life Expectancy

Log-Linear Model in R

log_lin_reg <- lm(loglife~gdp_t, data = gapminder)log_lin_reg %>% tidy()$$\widehat{ln(\text{Life Expectancy})}_i=3.967+0.013 \, \text{GDP}_i$$

A $1 (thousand) change in GDP \(\rightarrow\) a \(0.013 \times 100\%=\) 1.3% increase in Life Expectancy

A $25 (thousand) fall in GDP \(\rightarrow\) a \((-25 \times 1.3\%)=\) 32.5% decrease in Life Expectancy

A $100 (thousand) rise in GDP \(\rightarrow\) a \((100 \times 1.3\%)=\) 130% increase in Life Expectancy

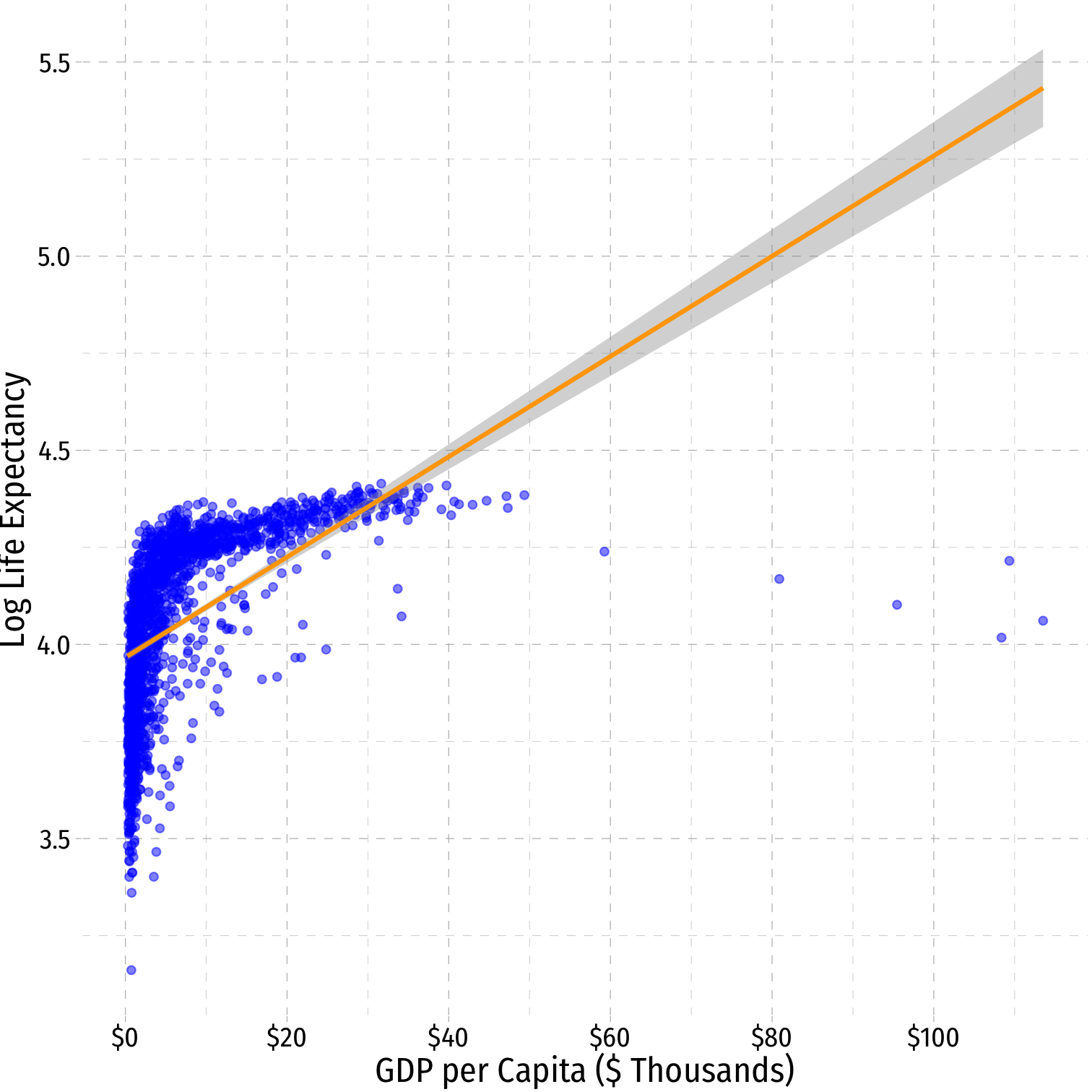

Linear-Log Model Graph I

ggplot(data = gapminder)+ aes(x = gdp_t, y = loglife)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", color="orange")+ scale_x_continuous(labels=scales::dollar, breaks=seq(0,120,20))+ labs(x = "GDP per Capita ($ Thousands)", y = "Log Life Expectancy")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)

Log-Log Model

Log-Log Model

- Log-log model has both variables \((X \text{ and } Y)\) logged

Log-Log Model

- Log-log model has both variables \((X \text{ and } Y)\) logged

$$\begin{align*} \color{#e64173}{\ln Y_i}&=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\\ \beta_1&=\cfrac{\big(\frac{\Delta Y}{Y}\big)}{\big(\frac{\Delta X}{X}\big)}\\ \end{align*}$$

Log-Log Model

- Log-log model has both variables \((X \text{ and } Y)\) logged

$$\begin{align*} \color{#e64173}{\ln Y_i}&=\beta_0+\beta_1 \color{#e64173}{\ln X_i}\\ \beta_1&=\cfrac{\big(\frac{\Delta Y}{Y}\big)}{\big(\frac{\Delta X}{X}\big)}\\ \end{align*}$$

Marginal effect of \(\mathbf{X \rightarrow Y}\): a 1% change in \(X \rightarrow\) a \(\beta_1\) % change in \(Y\)

\(\beta_1\) is the elasticity of \(Y\) with respect to \(X\)!

Log-Log Model in R

log_log_reg <- lm(loglife ~ loggdp, data = gapminder)log_log_reg %>% tidy()$$\widehat{\text{ln Life Expectancy}}_i=2.864+0.147 \, \text{ln GDP}_i$$

Log-Log Model in R

log_log_reg <- lm(loglife ~ loggdp, data = gapminder)log_log_reg %>% tidy()$$\widehat{\text{ln Life Expectancy}}_i=2.864+0.147 \, \text{ln GDP}_i$$

- A 1% change in GDP \(\rightarrow\) a 0.147% increase in Life Expectancy

Log-Log Model in R

log_log_reg <- lm(loglife ~ loggdp, data = gapminder)log_log_reg %>% tidy()$$\widehat{\text{ln Life Expectancy}}_i=2.864+0.147 \, \text{ln GDP}_i$$

A 1% change in GDP \(\rightarrow\) a 0.147% increase in Life Expectancy

A 25% fall in GDP \(\rightarrow\) a \((-25 \times 0.147\%)=\) 3.675% decrease in Life Expectancy

Log-Log Model in R

log_log_reg <- lm(loglife ~ loggdp, data = gapminder)log_log_reg %>% tidy()$$\widehat{\text{ln Life Expectancy}}_i=2.864+0.147 \, \text{ln GDP}_i$$

A 1% change in GDP \(\rightarrow\) a 0.147% increase in Life Expectancy

A 25% fall in GDP \(\rightarrow\) a \((-25 \times 0.147\%)=\) 3.675% decrease in Life Expectancy

A 100% rise in GDP \(\rightarrow\) a \((100 \times 0.147\%)=\) 14.7% increase in Life Expectancy

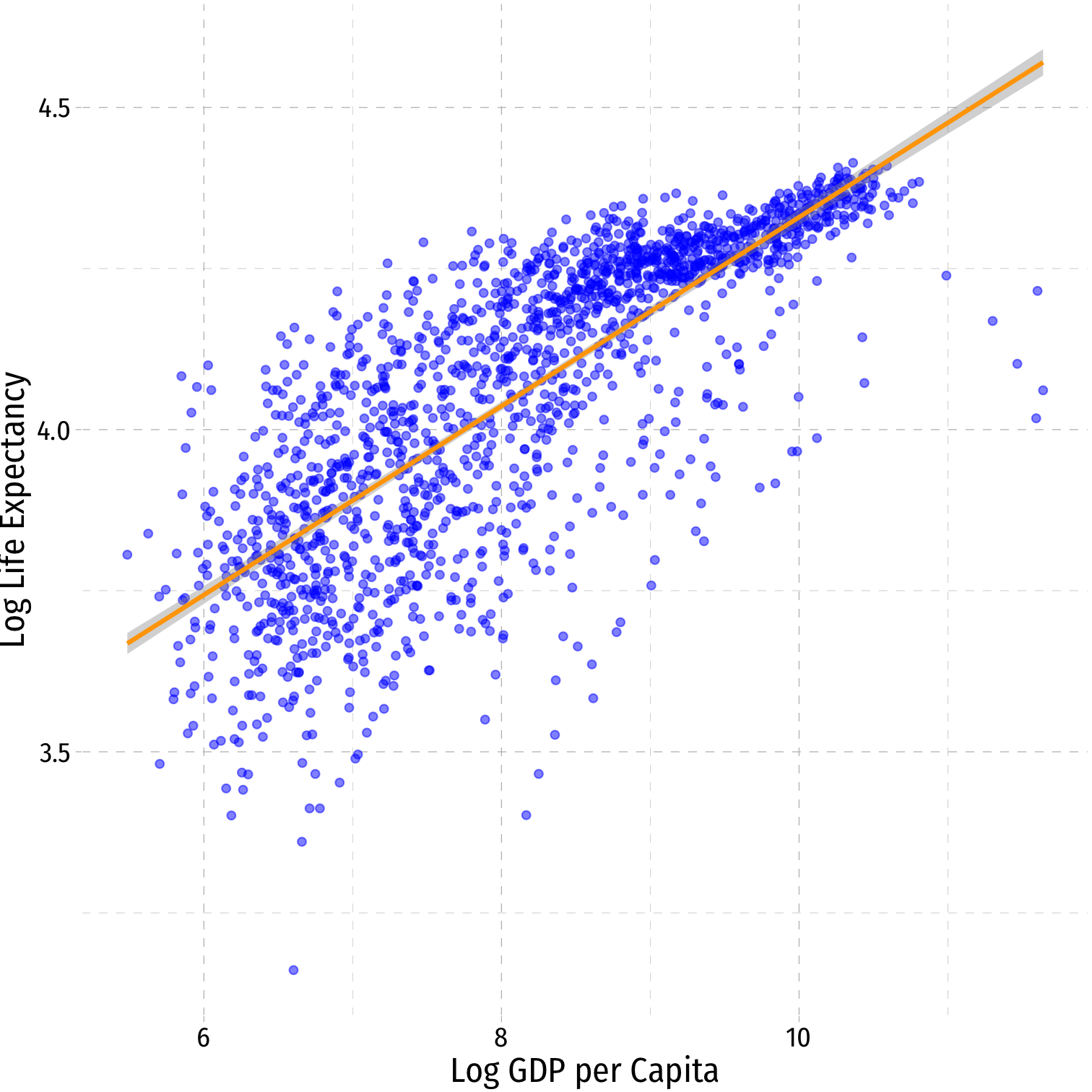

Log-Log Model Graph I

ggplot(data = gapminder)+ aes(x = loggdp, y = loglife)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", color="orange")+ labs(x = "Log GDP per Capita", y = "Log Life Expectancy")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)

Comparing Models I

| Model | Equation | Interpretation |

|---|---|---|

| Linear-Log | \(Y=\beta_0+\beta_1 \color{#e64173}{\ln X}\) | 1% change in \(X \rightarrow \frac{\hat{\beta_1}}{100}\) unit change in \(Y\) |

| Log-Linear | \(\color{#e64173}{\ln Y}=\beta_0+\beta_1X\) | 1 unit change in \(X \rightarrow \hat{\beta_1}\times 100\)% change in \(Y\) |

| Log-Log | \(\color{#e64173}{\ln Y}=\beta_0+\beta_1\color{#e64173}{\ln X}\) | 1% change in \(X \rightarrow \hat{\beta_1}\)% change in \(Y\) |

- Hint: the variable that gets logged changes in percent terms, the variable not logged changes in unit terms

- Going from units \(\rightarrow\) percent: multiply by 100

- Going from percent \(\rightarrow\) units: divide by 100

Comparing Models II

library(huxtable)huxreg("Life Exp." = lin_log_reg, "Log Life Exp." = log_lin_reg, "Log Life Exp." = log_log_reg, coefs = c("Constant" = "(Intercept)", "GDP ($1000s)" = "gdp_t", "Log GDP" = "loggdp"), statistics = c("N" = "nobs", "R-Squared" = "r.squared", "SER" = "sigma"), number_format = 2)- Models are very different units, how to choose?

- Compare \(R^2\)’s

- Compare graphs

- Compare intution

| Life Exp. | Log Life Exp. | Log Life Exp. | |

|---|---|---|---|

| Constant | -9.10 *** | 3.97 *** | 2.86 *** |

| (1.23) | (0.01) | (0.02) | |

| GDP ($1000s) | 0.01 *** | ||

| (0.00) | |||

| Log GDP | 8.41 *** | 0.15 *** | |

| (0.15) | (0.00) | ||

| N | 1704 | 1704 | 1704 |

| R-Squared | 0.65 | 0.30 | 0.61 |

| SER | 7.62 | 0.19 | 0.14 |

| *** p < 0.001; ** p < 0.01; * p < 0.05. | |||

Comparing Models III

| Linear-Log | Log-Linear | Log-Log |

|---|---|---|

|

|

|

| \(\hat{Y_i}=\hat{\beta_0}+\hat{\beta_1}\color{#e64173}{\ln X_i}\) | \(\color{#e64173}{\ln Y_i}=\hat{\beta_0}+\hat{\beta_1}X_i\) | \(\color{#e64173}{\ln Y_i}=\hat{\beta_0}+\hat{\beta_1}\color{#e64173}{\ln X_i}\) |

| \(R^2=0.65\) | \(R^2=0.30\) | \(R^2=0.61\) |

When to Log?

- In practice, the following types of variables are logged:

- Variables that must always be positive (prices, sales, market values)

- Very large numbers (population, GDP)

- Variables we want to talk about as percentage changes or growth rates (money supply, population, GDP)

- Variables that have diminishing returns (output, utility)

- Variables that have nonlinear scatterplots

When to Log?

- In practice, the following types of variables are logged:

- Variables that must always be positive (prices, sales, market values)

- Very large numbers (population, GDP)

- Variables we want to talk about as percentage changes or growth rates (money supply, population, GDP)

- Variables that have diminishing returns (output, utility)

- Variables that have nonlinear scatterplots

- Avoid logs for:

- Variables that are less than one, decimals, 0, or negative

- Categorical variables (season, gender, political party)

- Time variables (year, week, day)

Comparing Across Units

Comparing Coefficients of Different Units I

$$\hat{Y_i}=\beta_0+\beta_1 X_1+\beta_2 X_2 $$

We often want to compare coefficients to see which variable \(X_1\) or \(X_2\) has a bigger effect on \(Y\)

What if \(X_1\) and \(X_2\) are different units?

Example: $$\begin{align*} \widehat{\text{Salary}_i}&=\beta_0+\beta_1\, \text{Batting average}_i+\beta_2\, \text{Home runs}_i\\ \widehat{\text{Salary}_i}&=-\text{2,869,439.40}+\text{12,417,629.72} \, \text{Batting average}_i+\text{129,627.36}\, \text{Home runs}_i\\ \end{align*}$$

Comparing Coefficients of Different Units II

- An easy way is to standardize† the variables (i.e. take the \(Z\)-score)

$$X_Z=\frac{X_i-\overline{X}}{sd(X)}$$

† Also called “centering” or “scaling.”

Comparing Coefficients of Different Units: Example

| Variable | Mean | Std. Dev. |

|---|---|---|

| Salary | $2,024,616 | $2,764,512 |

| Batting Average | 0.267 | 0.031 |

| Home Runs | 12.11 | 10.31 |

$$\begin{align*}\scriptsize \widehat{\text{Salary}_i}&=-\text{2,869,439.40}+\text{12,417,629.72} \, \text{Batting average}_i+\text{129,627.36} \, \text{Home runs}_i\\ \widehat{\text{Salary}_Z}&=\text{0.00}+\text{0.14} \, \text{Batting average}_Z+\text{0.48} \, \text{Home runs}_Z\\ \end{align*}$$

Comparing Coefficients of Different Units: Example

| Variable | Mean | Std. Dev. |

|---|---|---|

| Salary | $2,024,616 | $2,764,512 |

| Batting Average | 0.267 | 0.031 |

| Home Runs | 12.11 | 10.31 |

$$\begin{align*}\scriptsize \widehat{\text{Salary}_i}&=-\text{2,869,439.40}+\text{12,417,629.72} \, \text{Batting average}_i+\text{129,627.36} \, \text{Home runs}_i\\ \widehat{\text{Salary}_Z}&=\text{0.00}+\text{0.14} \, \text{Batting average}_Z+\text{0.48} \, \text{Home runs}_Z\\ \end{align*}$$

Marginal effects on \(Y\) (in standard deviations of \(Y\)) from 1 standard deviation change in \(X\):

\(\hat{\beta_1}\): a 1 standard deviation increase in Batting Average increases Salary by 0.14 standard deviations

$$0.14 \times \$2,764,512=\$387,032$$

- \(\hat{\beta_2}\): a 1 standard deviation increase in Home Runs increases Salary by 0.48 standard deviations

$$0.48 \times \$2,764,512=\$1,326,966$$

Standardizing in R

| Variable | Mean | SD |

|---|---|---|

LifeExp |

59.47 | 12.92 |

gdpPercap |

$7215.32 | $9857.46 |

- Use the

scale()command insidemutate()function to standardize a variable

gapminder <- gapminder %>% mutate(life_Z = scale(lifeExp), gdp_Z = scale(gdpPercap))std_reg <- lm(life_Z ~ gdp_Z, data = gapminder)tidy(std_reg)## # A tibble: 2 × 5## term estimate std.error statistic p.value## <chr> <dbl> <dbl> <dbl> <dbl>## 1 (Intercept) 1.10e-16 0.0197 5.57e-15 1.00e+ 0## 2 gdp_Z 5.84e- 1 0.0197 2.97e+ 1 3.57e-156- A 1 standard deviation increase in

gdpPercapwill increaselifeExpby 0.584 standard deviations \((0.584 \times 12.92 = = 7.55\) years)

Joint Hypothesis Testing

Joint Hypothesis Testing I

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

Joint Hypothesis Testing I

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

- Maybe region doesn't affect wages at all?

Joint Hypothesis Testing I

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

Maybe region doesn't affect wages at all?

\(H_0: \beta_2=0, \, \beta_3=0, \, \beta_4=0\)

Joint Hypothesis Testing I

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

Maybe region doesn't affect wages at all?

\(H_0: \beta_2=0, \, \beta_3=0, \, \beta_4=0\)

This is a joint hypothesis to test

Joint Hypothesis Testing II

- A joint hypothesis tests against the null hypothesis of a value for multiple parameters: $$\mathbf{H_0: \beta_1= \beta_2=0}$$ the hypotheses that multiple regressors are equal to zero (have no causal effect on the outcome)

Joint Hypothesis Testing II

A joint hypothesis tests against the null hypothesis of a value for multiple parameters: $$\mathbf{H_0: \beta_1= \beta_2=0}$$ the hypotheses that multiple regressors are equal to zero (have no causal effect on the outcome)

Our alternative hypothesis is that: $$H_1: \text{ either } \beta_1\neq0\text{ or } \beta_2\neq0\text{ or both}$$ or simply, that \(H_0\) is not true

Types of Joint Hypothesis Tests

1) \(H_0\): \(\beta_1=\beta_2=0\)

- Testing against the claim that multiple variables don't matter

- Useful under high multicollinearity between variables

- \(H_a\): at least one parameter \(\neq\) 0

Types of Joint Hypothesis Tests

1) \(H_0\): \(\beta_1=\beta_2=0\)

- Testing against the claim that multiple variables don't matter

- Useful under high multicollinearity between variables

- \(H_a\): at least one parameter \(\neq\) 0

2) \(H_0\): \(\beta_1=\beta_2\)

- Testing whether two variables matter the same

- Variables must be the same units

- \(H_a: \beta_1 (\neq, <, \text{ or }>) \beta_2\)

Types of Joint Hypothesis Tests

1) \(H_0\): \(\beta_1=\beta_2=0\)

- Testing against the claim that multiple variables don't matter

- Useful under high multicollinearity between variables

- \(H_a\): at least one parameter \(\neq\) 0

2) \(H_0\): \(\beta_1=\beta_2\)

- Testing whether two variables matter the same

- Variables must be the same units

- \(H_a: \beta_1 (\neq, <, \text{ or }>) \beta_2\)

3) \(H_0:\) ALL \(\beta\)'s \(=0\)

- The "Overall F-test"

- Testing against claim that regression model explains NO variation in \(Y\)

Joint Hypothesis Tests: F-statistic

- The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

Joint Hypothesis Tests: F-statistic

The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

This involves comparing two models:

- Unrestricted model: regression with all coefficients

- Restricted model: regression under null hypothesis (coefficients equal hypothesized values)

Joint Hypothesis Tests: F-statistic

The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

This involves comparing two models:

- Unrestricted model: regression with all coefficients

- Restricted model: regression under null hypothesis (coefficients equal hypothesized values)

\(F\) is an analysis of variance (ANOVA)

- essentially tests whether \(R^2\) increases statistically significantly as we go from the restricted model$\rightarrow$unrestricted model

Joint Hypothesis Tests: F-statistic

The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

This involves comparing two models:

- Unrestricted model: regression with all coefficients

- Restricted model: regression under null hypothesis (coefficients equal hypothesized values)

\(F\) is an analysis of variance (ANOVA)

- essentially tests whether \(R^2\) increases statistically significantly as we go from the restricted model$\rightarrow$unrestricted model

\(F\) has its own distribution, with two sets of degrees of freedom

Joint Hypothesis F-test: Example I

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

Joint Hypothesis F-test: Example I

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

- \(H_0: \beta_2=\beta_3=\beta_4=0\)

Joint Hypothesis F-test: Example I

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

\(H_0: \beta_2=\beta_3=\beta_4=0\)

\(H_a\): \(H_0\) is not true (at least one \(\beta_i \neq 0\))

Joint Hypothesis F-test: Example II

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

- Unrestricted model:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

Joint Hypothesis F-test: Example II

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

- Unrestricted model:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

- Restricted model:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i$$

Joint Hypothesis F-test: Example II

Example: Return again to:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

- Unrestricted model:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Midwest_i+\hat{\beta_4}South_i$$

- Restricted model:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Male_i$$

- \(F\)-test: does going from restricted to unrestricted model statistically significantly improve \(R^2\)?

Calculating the F-statistic

$$F_{q,(n-k-1)}=\cfrac{\left(\displaystyle\frac{(R^2_u-R^2_r)}{q}\right)}{\left(\displaystyle\frac{(1-R^2_u)}{(n-k-1)}\right)}$$

Calculating the F-statistic

$$F_{q,(n-k-1)}=\cfrac{\left(\displaystyle\frac{(\color{#e64173}{R^2_u}-R^2_r)}{q}\right)}{\left(\displaystyle\frac{(1-\color{#e64173}{R^2_u})}{(n-k-1)}\right)}$$

- \(\color{#e64173}{R^2_u}\): the \(R^2\) from the unrestricted model (all variables)

Calculating the F-statistic

$$F_{q,(n-k-1)}=\cfrac{\left(\displaystyle\frac{(\color{#e64173}{R^2_u}-\color{#6A5ACD}{R^2_r})}{q}\right)}{\left(\displaystyle\frac{(1-\color{#e64173}{R^2_u})}{(n-k-1)}\right)}$$

\(\color{#e64173}{R^2_u}\): the \(R^2\) from the unrestricted model (all variables)

\(\color{#6A5ACD}{R^2_r}\): the \(R^2\) from the restricted model (null hypothesis)

Calculating the F-statistic

$$F_{q,(n-k-1)}=\cfrac{\left(\displaystyle\frac{(\color{#e64173}{R^2_u}-\color{#6A5ACD}{R^2_r})}{q}\right)}{\left(\displaystyle\frac{(1-\color{#e64173}{R^2_u})}{(n-k-1)}\right)}$$

\(\color{#e64173}{R^2_u}\): the \(R^2\) from the unrestricted model (all variables)

\(\color{#6A5ACD}{R^2_r}\): the \(R^2\) from the restricted model (null hypothesis)

\(q\): number of restrictions (number of \(\beta's=0\) under null hypothesis)

Calculating the F-statistic

$$F_{q,(n-k-1)}=\cfrac{\left(\displaystyle\frac{(\color{#e64173}{R^2_u}-\color{#6A5ACD}{R^2_r})}{q}\right)}{\left(\displaystyle\frac{(1-\color{#e64173}{R^2_u})}{(n-k-1)}\right)}$$

\(\color{#e64173}{R^2_u}\): the \(R^2\) from the unrestricted model (all variables)

\(\color{#6A5ACD}{R^2_r}\): the \(R^2\) from the restricted model (null hypothesis)

\(q\): number of restrictions (number of \(\beta's=0\) under null hypothesis)

\(k\): number of \(X\) variables in unrestricted model (all variables)

Calculating the F-statistic

$$F_{q,(n-k-1)}=\cfrac{\left(\displaystyle\frac{(\color{#e64173}{R^2_u}-\color{#6A5ACD}{R^2_r})}{q}\right)}{\left(\displaystyle\frac{(1-\color{#e64173}{R^2_u})}{(n-k-1)}\right)}$$

\(\color{#e64173}{R^2_u}\): the \(R^2\) from the unrestricted model (all variables)

\(\color{#6A5ACD}{R^2_r}\): the \(R^2\) from the restricted model (null hypothesis)

\(q\): number of restrictions (number of \(\beta's=0\) under null hypothesis)

\(k\): number of \(X\) variables in unrestricted model (all variables)

\(F\) has two sets of degrees of freedom:

- \(q\) for the numerator, \((n-k-1)\) for the denominator

Calculating the F-statistic II

$$F_{q,(n-k-1)}=\cfrac{\left(\displaystyle\frac{(R^2_u-R^2_r)}{q}\right)}{\left(\displaystyle\frac{(1-R^2_u)}{(n-k-1)}\right)}$$

Key takeaway: The bigger the difference between \((R^2_u-R^2_r)\), the greater the improvement in fit by adding variables, the larger the \(F\)!

This formula is (believe it or not) actually a simplified version (assuming homoskedasticity)

- I give you this formula to build your intuition of what F is measuring

F-test Example I

- We'll use the

wooldridgepackage'swage1data again

# load in data from wooldridge packagelibrary(wooldridge)wages <- wage1# run regressionsunrestricted_reg <- lm(wage ~ female + northcen + west + south, data = wages)restricted_reg <- lm(wage ~ female, data = wages)F-test Example II

- Unrestricted model:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Female_i+\hat{\beta_2}Northeast_i+\hat{\beta_3}Northcen+\hat{\beta_4}South_i$$

- Restricted model:

$$\widehat{Wage_i}=\hat{\beta_0}+\hat{\beta_1}Female_i$$

\(H_0: \beta_2 = \beta_3 = \beta_4 =0\)

\(q = 3\) restrictions (F numerator df)

\(n-k-1 = 526-4-1=521\) (F denominator df)

F-test Example III

- We can use the

carpackage'slinearHypothesis()command to run an \(F\)-test:- first argument: name of the (unrestricted) regression

- second argument: vector of variable names (in quotes) you are testing

F-test Example III

- We can use the

carpackage'slinearHypothesis()command to run an \(F\)-test:- first argument: name of the (unrestricted) regression

- second argument: vector of variable names (in quotes) you are testing

# load car package for additional regression toolslibrary(car) # F-testlinearHypothesis(unrestricted_reg, c("northcen", "west", "south"))## Linear hypothesis test## ## Hypothesis:## northcen = 0## west = 0## south = 0## ## Model 1: restricted model## Model 2: wage ~ female + northcen + west + south## ## Res.Df RSS Df Sum of Sq F Pr(>F) ## 1 524 6332.2 ## 2 521 6174.8 3 157.36 4.4258 0.004377 **## ---## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1F-test Example III

- We can use the

carpackage'slinearHypothesis()command to run an \(F\)-test:- first argument: name of the (unrestricted) regression

- second argument: vector of variable names (in quotes) you are testing

# load car package for additional regression toolslibrary(car) # F-testlinearHypothesis(unrestricted_reg, c("northcen", "west", "south"))## Linear hypothesis test## ## Hypothesis:## northcen = 0## west = 0## south = 0## ## Model 1: restricted model## Model 2: wage ~ female + northcen + west + south## ## Res.Df RSS Df Sum of Sq F Pr(>F) ## 1 524 6332.2 ## 2 521 6174.8 3 157.36 4.4258 0.004377 **## ---## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1- \(p\)-value on \(F\)-test \(<0.05\), so we can reject \(H_0\)

Second F-test Example: Are Two Coefficients Equal?

- The second type of test is whether two coefficients equal one another

Example:

$$\widehat{wage_i}=\beta_0+\beta_1 \text{Adolescent height}_i + \beta_2 \text{Adult height}_i + \beta_3 \text{Male}_i$$

Second F-test Example: Are Two Coefficients Equal?

- The second type of test is whether two coefficients equal one another

Example:

$$\widehat{wage_i}=\beta_0+\beta_1 \text{Adolescent height}_i + \beta_2 \text{Adult height}_i + \beta_3 \text{Male}_i$$

- Does height as an adolescent have the same effect on wages as height as an adult?

$$H_0: \beta_1=\beta_2$$

Second F-test Example: Are Two Coefficients Equal?

- The second type of test is whether two coefficients equal one another

Example:

$$\widehat{wage_i}=\beta_0+\beta_1 \text{Adolescent height}_i + \beta_2 \text{Adult height}_i + \beta_3 \text{Male}_i$$

- Does height as an adolescent have the same effect on wages as height as an adult?

$$H_0: \beta_1=\beta_2$$

- What is the restricted regression?

$$\widehat{wage_i}=\beta_0+\beta_1(\text{Adolescent height}_i + \text{Adult height}_i )+ \beta_3 \text{Male}_i$$

- \(q=1\) restriction

Second F-test Example: Data

# load in dataheightwages <- read_csv("../data/heightwages.csv")# make a "heights" variable as the sum of adolescent (height81) and adult (height85) heightheightwages <- heightwages %>% mutate(heights = height81 + height85)height_reg <- lm(wage96 ~ height81 + height85 + male, data = heightwages)height_restricted_reg <- lm(wage96 ~ heights + male, data = heightwages)Second F-test Example: Data

- For second argument, set two variables equal, in quotes

linearHypothesis(height_reg, "height81 = height85") # F-test## Linear hypothesis test## ## Hypothesis:## height81 - height85 = 0## ## Model 1: restricted model## Model 2: wage96 ~ height81 + height85 + male## ## Res.Df RSS Df Sum of Sq F Pr(>F)## 1 6591 5128243 ## 2 6590 5127284 1 959.2 1.2328 0.2669Insufficient evidence to reject \(H_0\)!

The effect of adolescent and adult height on wages is the same

All F-test I

summary(unrestricted_reg)## ## Call:## lm(formula = wage ~ female + northcen + west + south, data = wages)## ## Residuals:## Min 1Q Median 3Q Max ## -6.3269 -2.0105 -0.7871 1.1898 17.4146 ## ## Coefficients:## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 7.5654 0.3466 21.827 <2e-16 ***## female -2.5652 0.3011 -8.520 <2e-16 ***## northcen -0.5918 0.4362 -1.357 0.1755 ## west 0.4315 0.4838 0.892 0.3729 ## south -1.0262 0.4048 -2.535 0.0115 * ## ---## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1## ## Residual standard error: 3.443 on 521 degrees of freedom## Multiple R-squared: 0.1376, Adjusted R-squared: 0.131 ## F-statistic: 20.79 on 4 and 521 DF, p-value: 6.501e-16- Last line of regression output from

summary()is an All F-test- \(H_0:\) all \(\beta's=0\)

- the regression explains no variation in \(Y\)

- Calculates an

F-statisticthat, if high enough, is significant (p-value\(<0.05)\) enough to reject \(H_0\)

- \(H_0:\) all \(\beta's=0\)

All F-test II

- Alternatively, if you use

broominstead ofsummary():glance()command makes table of regression summary statisticstidy()only shows coefficients

library(broom)glance(unrestricted_reg)## # A tibble: 1 × 12## r.squared adj.r.squared sigma statistic p.value df logLik AIC BIC## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>## 1 0.138 0.131 3.44 20.8 6.50e-16 4 -1394. 2800. 2826.## # … with 3 more variables: deviance <dbl>, df.residual <int>, nobs <int>statisticis the All F-test,p.valuenext to it is the p-value from the F test